The CCSI was assessed at C$5.14 per gram this week, up 0.7% from last week’s C$5.11 per gram. This week’s price equates to US$1,850 per pound at the current exchange rate.

Each week, Business of Cannabis delivers a series of insights from our partners at Cannabis Benchmarks®.

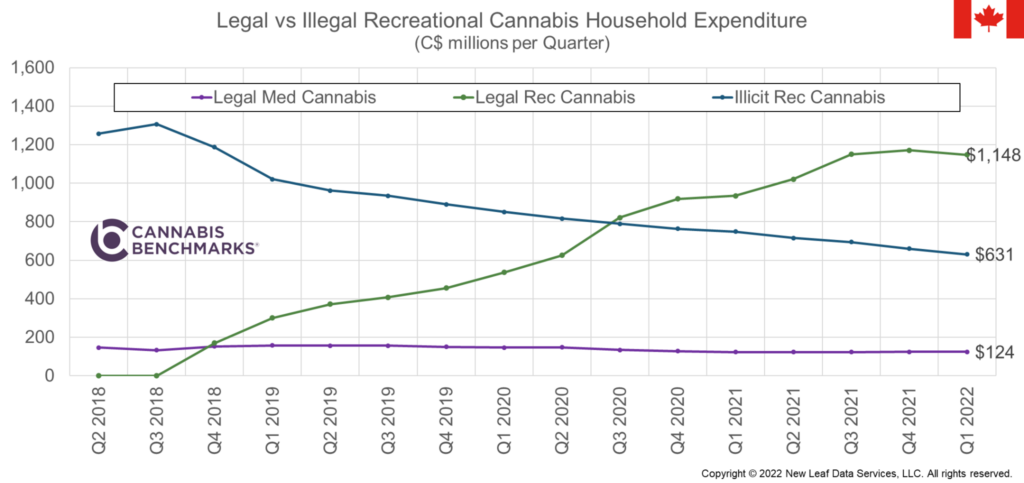

This week we examine household expenditure data issued quarterly by Statistics Canada. To start, we look at the rise of the legal recreational cannabis market across Canada. As seen in the chart below, in Q1 2022 the estimated household expenditure for legal recreational cannabis was nearly 82% greater than that spent in the illicit market.

More Canadians are choosing to purchase cannabis through regulated legal channels as awareness and accessibility continue to expand. Also fueling that trend is the drop in prices, as new supplies from legal indoor and outdoor cultivation operations became available and make products from licensed businesses more price competitive with those of illegal sellers.

In Q1 2022, recreational cannabis expenditures grew 23% to C$1,148M and illicit cannabis expenditures dropped by 16% to C$631M as compared to the same time frame in 2021. We also note that expenditure for medical-use cannabis stayed relatively flat at C$124M. Medical cannabis now makes up only 6.5% of the total cannabis bought in Canada. Total expenditure on cannabis was C$1.78B for the quarter or C$19.7M per day.

Source: Canada Cannabis Spot Index, Cannabis Benchmarks

See previous weekly updates from Cannabis Benchmarks:

- A look at Canada’s latest retail cannabis sales data

- A complete view of trends following the introduction of cannabis 2.0 products.

- The ongoing battle between legal and illegal cannabis sales in Ontario

- How legal cannabis sales in Canada have impacted alcohol sales

- Understanding the current cannabis store county in Canada right now

- Canadian cannabis market fundamentals right now

- How the growth of outdoor cannabis cultivation impacts Canadian cannabis

- Canadian cannabis retail store count right now

- Flattening cannabis sales part of a common trend?

- Cannabis sales and store insights from BC

- Cannabis store count in Alberta right now

- A look at monthly cannabis sales in Canada

- How to compare annual cumulative cannabis sales in Canada

- Canadian cannabis consumer and patient trends right now

- Daily cannabis spend per consumer in BC now

- Canadian retail store counts right now

- A look at average daily cannabis sales in Canada

- Future growth of cannabis retail in Alberta

- Retail store counts in Canada right now

- The mix of cannabis products in Ontario right now

- How to understand legal and illicit cannabis sales

- Comparing legal and illicit cannabis purchases right now

- A look at cannabis retail store counts in Canada

- A look at daily cannabis retail sales in Canada

- Legacy and legal cannabis sales three years after legalization?

- How to understand cannabis’ impact on alcohol sales in Canada

- Understanding cannabis retail store growth in Canada

- A look at average monthly spend per cannabis consumer

- A look at processing licenses issued by Health Canada

- A look at cultivation licenses issued by Health Canada

- Understanding medical versus recreational sales right now

- A look at daily cannabis sales by Province

- How to view dry cannabis sales across Canada

- A look at percentage of legal versus illicit cannabis sales

- A look at the pace of growth for cannabis retail

- A look at monthly cannabis sales in Ontario

- What is the optimal number of cannabis stores in Canada?

- How to compare daily cannabis retail sales by Province