The Canada Cannabis Spot Index was assessed at C$5.18 per gram this week, up 0.4% from last week’s C$5.16 per gram. This week’s price equates to US$1,831 per pound at the current exchange rate.

Each week, Business of Cannabis delivers a series of insights from our partners at Cannabis Benchmarks®.

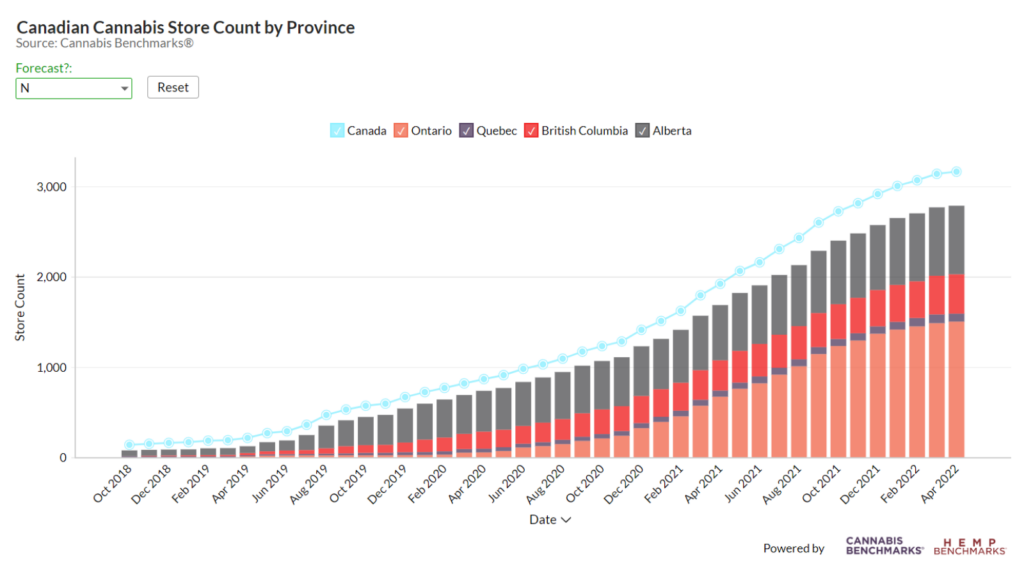

The Canadian cannabis industry continues to open new retail outlets across the country at a steady pace. As of the end of April, Cannabis Benchmarks counted 3,162 licensed retailers. The pace of store openings has slowed considerably in 2022 so far relative to 2021.

In 2021, Cannabis Benchmarks counted 125 new stores opened each month, on average, with 70% of new store openings occurring in Ontario. So far in 2022, new store openings have declined to an average of 62 each month.

Alberta remains an outlier, with stores continuing to open despite it having the smallest population of the four major provinces. Cannabis Benchmarks expects the number of stores in Alberta to decline over the next 24 months, as competition intensifies and store economics become less favorable. British Columbia’s store count, meanwhile, is growing at a steady rate, while Ontario’s exponential growth in 2021 allowed it to catch up to a more respectable level. Quebec remains the biggest laggard this year, with the slowest rollout due to the provincial government owning and operating all cannabis retail operations.

To better understand the number of stores required, Cannabis Benchmarks looked to Colorado and Oregon, two of the most mature legal cannabis markets in the U.S. that do not place an artificial cap on the number of stores permitted to open. In Colorado, there is one recreational retailer for about every 9,600 residents while in Oregon there is one legal store for about every 6,150 people. Using that example, we assume one store should ideally serve around 7,500 people. Based on this analysis, Canada as a whole would require a total of 5,137 stores, or 1.6 times the current number of retailers. Other than Alberta, every province is still behind its optimal level. That being said, Cannabis Benchmarks saw meaningful progress made in comparison to 2021 and continue to see this trend moving in the right direction.

Source: Canada Cannabis Spot Index, Cannabis Benchmarks

See previous weekly updates from Cannabis Benchmarks:

- How revised cannabis sales figures alter last year’s numbers

- Canadian cannabis market fundamentals right now

- How the growth of outdoor cannabis cultivation impacts Canadian cannabis

- Canadian cannabis retail store count right now

- Flattening cannabis sales part of a common trend?

- Cannabis sales and store insights from BC

- Cannabis store count in Alberta right now

- A look at monthly cannabis sales in Canada

- How to compare annual cumulative cannabis sales in Canada

- Canadian cannabis consumer and patient trends right now

- Daily cannabis spend per consumer in BC now

- Canadian retail store counts right now

- A look at average daily cannabis sales in Canada

- Future growth of cannabis retail in Alberta

- Retail store counts in Canada right now

- The mix of cannabis products in Ontario right now

- How to understand legal and illicit cannabis sales

- Comparing legal and illicit cannabis purchases right now

- A look at cannabis retail store counts in Canada

- A look at daily cannabis retail sales in Canada

- Legacy and legal cannabis sales three years after legalization?

- How to understand cannabis’ impact on alcohol sales in Canada

- Understanding cannabis retail store growth in Canada

- A look at average monthly spend per cannabis consumer

- A look at processing licenses issued by Health Canada

- A look at cultivation licenses issued by Health Canada

- Understanding medical versus recreational sales right now

- A look at daily cannabis sales by Province

- How to view dry cannabis sales across Canada

- A look at percentage of legal versus illicit cannabis sales

- A look at the pace of growth for cannabis retail

- A look at monthly cannabis sales in Ontario

- What is the optimal number of cannabis stores in Canada?

- How to compare daily cannabis retail sales by Province

- Understanding the impact of cannabis on alcohol sales in Canada

- A look at cannabis retail store count by Province

- A look at cannabis user statistics in Canada