The CCSI was assessed at C$5.11 per gram this week, up from last week’s C$5.09 per gram. This week’s price equates to US$1,838 per pound at the current exchange rate.

Each week, Business of Cannabis delivers a series of insights from our partners at Cannabis Benchmarks®.

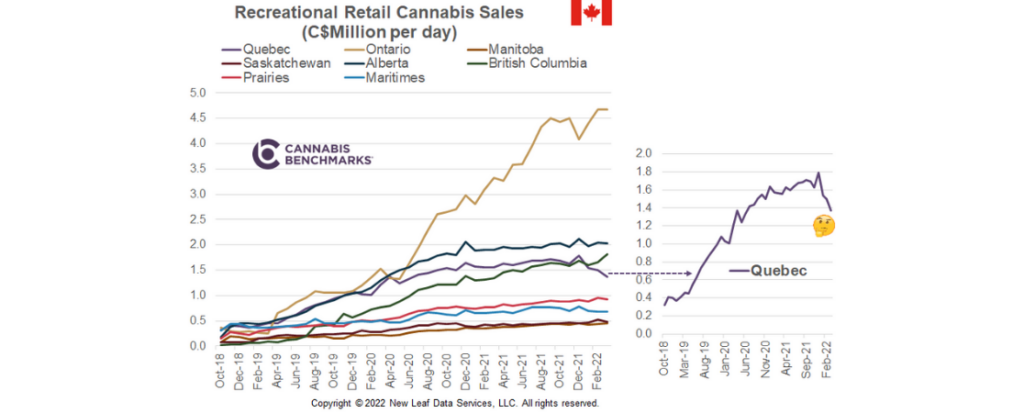

This week we review the latest retail cannabis sales data published by Statistics Canada. The latest release shows cannabis sales increasing by 10.7% from February to March, to reach C$358.8M. February sales, however, were revised downward to C$324.1M from C$336.4M. Average daily sales have been flat for the past eight months, which is causing concern for the cannabis industry.

Recreational sales have recently been fairly flat across most provinces, with the exceptions of Ontario and Quebec. Ontario sales continue to grow, with added storefronts bringing new customers to the legal market. Quebec, on the other hand, has seen sales drop sharply since a peak of C$1.79M in daily sales in December 2021.

In general, Quebec’s cannabis sales have been much lower on a per capita basis than the other major Canadian provinces, due largely to its regulatory structure. First, the Quebec government has set the legal age for purchasing and consuming cannabis at 21. Other populous provinces have set the minimum age to purchase and consume cannabis at 18 (Alberta) or 19 (Ontario and British Columbia).

Second, Quebec has the lowest number of cannabis retail locations of the major provinces because legal cannabis products can only be sold through government-run Société Québécoise du Cannabis (SQDC) outlets. As of the end of May, we counted a total of 89 stores in Quebec, which is drastically lower than Alberta, a province that boasts 759 stores and only half the population of Quebec.

Source: Canada Cannabis Spot Index, Cannabis Benchmarks

See previous weekly updates from Cannabis Benchmarks:

- A complete view of trends following the introduction of cannabis 2.0 products.

- The ongoing battle between legal and illegal cannabis sales in Ontario

- How legal cannabis sales in Canada have impacted alcohol sales

- Understanding the current cannabis store county in Canada right now

- Canadian cannabis market fundamentals right now

- How the growth of outdoor cannabis cultivation impacts Canadian cannabis

- Canadian cannabis retail store count right now

- Flattening cannabis sales part of a common trend?

- Cannabis sales and store insights from BC

- Cannabis store count in Alberta right now

- A look at monthly cannabis sales in Canada

- How to compare annual cumulative cannabis sales in Canada

- Canadian cannabis consumer and patient trends right now

- Daily cannabis spend per consumer in BC now

- Canadian retail store counts right now

- A look at average daily cannabis sales in Canada

- Future growth of cannabis retail in Alberta

- Retail store counts in Canada right now

- The mix of cannabis products in Ontario right now

- How to understand legal and illicit cannabis sales

- Comparing legal and illicit cannabis purchases right now

- A look at cannabis retail store counts in Canada

- A look at daily cannabis retail sales in Canada

- Legacy and legal cannabis sales three years after legalization?

- How to understand cannabis’ impact on alcohol sales in Canada

- Understanding cannabis retail store growth in Canada

- A look at average monthly spend per cannabis consumer

- A look at processing licenses issued by Health Canada

- A look at cultivation licenses issued by Health Canada

- Understanding medical versus recreational sales right now

- A look at daily cannabis sales by Province

- How to view dry cannabis sales across Canada

- A look at percentage of legal versus illicit cannabis sales

- A look at the pace of growth for cannabis retail

- A look at monthly cannabis sales in Ontario

- What is the optimal number of cannabis stores in Canada?

- How to compare daily cannabis retail sales by Province