RECOVERY POSSIBLE?

Can cannabis stocks recover despite the slow pace of federal reform?

Shares of some of the largest MSOs, such as Curaleaf, Green Thumb Industries and Trulieve, have dropped more than 30% this past year, writes Bloomberg.

The slow pace of federal legalization, which still feels very far off, is to blame, say analysts. “Cannabis, with its many federal and state regulatory restrictions still in place, has been driven into recession by slow-moving policy changes,” wrote BTIG analyst Camilo Lyon in a research note on April 26.

The SAFE Banking Act or other federal legislative reform could change the game. But there are obstacles:

- Republicans will likely win control of the Senate this year

- Just four Republicans voted for the MORE Act in April

- Biden’s administration has expressed desire to reduce cannabis consumption in its first drug-control strategy

- But Biden’s recent commutations, which included several cannabis-related convictions, are a small sign of hope

“Decriminalization is so important to this industry,” Bloomberg Intelligence analyst Kenneth Shea said. “And the can keeps getting kicked down the line.”

Get the latest on the companies, brands, people and trends driving the cannabis industry in your inbox everyday.

Enjoy Cannabis Daily each morning at 7 a.m.

FROM CANNABIS BENCHMARKS

How revised cannabis sales figures alter last year’s numbers

Each week, Business of Cannabis delivers a series of insights from our partners at Cannabis Benchmarks®. Statistics Canada recently released retail sales data for February 2022, showing nationwide legal cannabis sales dropping from the previous month due to fewer total days. Sales in February slid to C$336.4M but increased on a daily basis. From January to February daily sales grew from an average of C$11.2M per day to C$12.0M per day, or a 7.5% increase. After relatively flat daily sales over the past six months, average daily sales grew to over C$12M per day for the first time.

See how revisions to 2021 numbers impact this year’s projections >>

MONEY, MONEY, MONEY

Financing activity plummets: Viridian Capital Advisors

Cannabis capital raises have dropped 67% in 2022 compared to 2021, according to Viridian Capital Advisors latest newsletter.

The stats

- In Canada, equity raises are down 94%; in the US, they’re down 73%

- Debt financing has also dropped in Canada 86%, but it’s up 72% (adding up to an overall decrease of 33%)

The reason for equity declines? Those aforementioned low valuations. The MSOS ETF, for example, is down 40% YTD. “No CFO wants to sell stock at such low prices, particularly if there is still any glimmer of hope that a positive legislative result could produce an upside catalyst,” writes Frank Colombo, CFA.

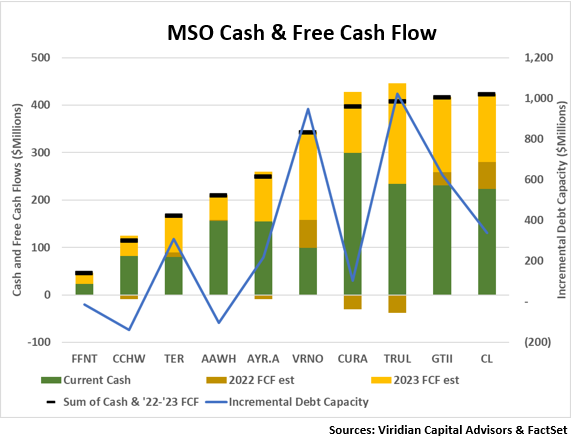

But why hasn’t debt financing filled the gap in capital raises? Well, according to Viridian, MSOs likely don’t need it—they have healthy cash balances. “If the analysts’ consensus is correct, the companies on this chart can internally fund their needs for 2022 and 2023, particularly given their healthy current cash balances.”

NO REP YET

Canadian cannabis producers see slight uptick in corporate reputation survey

Cannabis companies are some of the least reputable businesses according to Canadians, per Quebec market research firm Leger’s survey of more than 300 companies, reports MJBizDaily.

The rankings

- Shoppers Drug Mart was ranked #1

- Edmonton-based Aurora Cannabis was #180

- Canopy Growth Corp. was ranked at #186

- China’s Huawei and Montreal’s “scandal-plagued” SNC-Lavalin were at the bottom

But it’s a small improvement to previous survey results and doesn’t indicate that Canadians disapprove of cannabis. Instead, Leger executive VP Dave Scholz said it’s that they are simply not very well known. “The big factor is people just don’t know them,” Scholz said. “That awareness piece is huge in the reputation world. You look at Aurora, which has the highest rating, only 42% of Canadians say they’re even aware of them.”