Cantourage

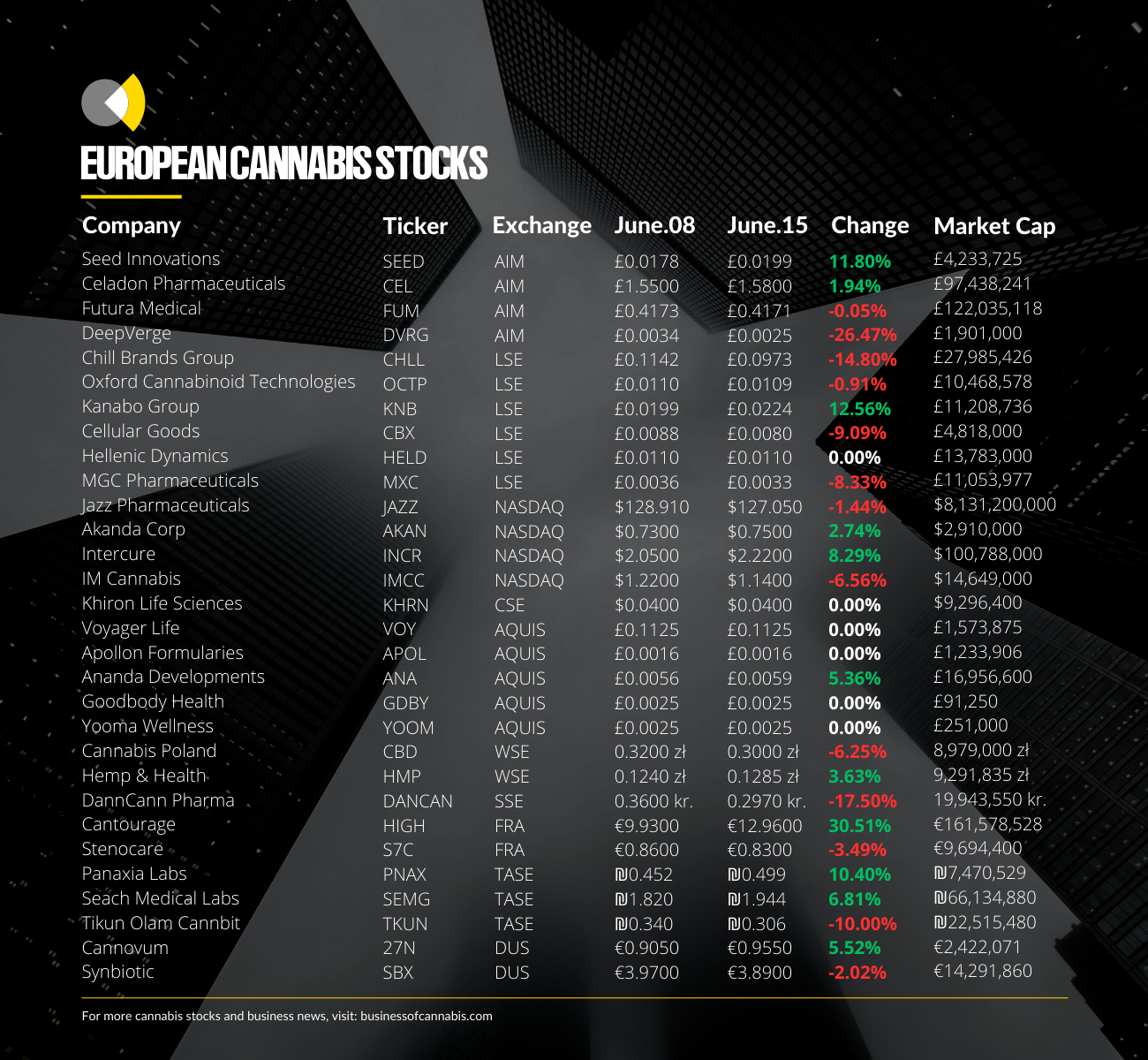

German-listed cannabis distributor has seen its stock price jump by around 30% this week on the Frankfurt stock exchange.

Since June 08, Cantourage’s stock price has jumped from €9.73 to around €12.38 at the time of writing, hitting levels not seen since January.

The spike has come despite no significant news or releases coming directly from the company. However, a number of external factors and reports may be responsible for the positive sentiment.

Its stock price growth coincided with news that the German Federal Institute for Drugs and Medical Devices (BfArM) is set to increase the price of German-grown medical cannabis flowers from €4.3 to €5.8 per gram from the first of July.

While this doesn’t directly impact Cantourage, currently the third-largest distributor of cannabis flower in Germany, the news may have created favourable market conditions for the company.

Currently only three companies have a tender to grow cannabis in Germany, Aurora, Tilray and Demecan, while Cansativa is the only company permitted to distribute medical cannabis grown in Germany.

According to a press release from BfArM: “Patients are preferably prescribed cannabis varieties with a high THC content. As a result, pharmacies have less demand for the varieties with a lower THC content, which are also offered by the BfArM.”

Elsewhere, as Business of Cannabis reported, Cantourage recently published its first profit, while the stock saw NuWays AG changed its recommendation from ‘Hold’ to ‘Buy’.

Intercure

The Israeli cannabis giant and its CEO are now being sued by Cann Pharmaceutical, also known as Better, as the legal dispute between the two companies that were once due to merge intensifies.

In February 2022, Intercure announced that it had signed a ‘definitive agreement’ to acquire its Israeli medical cannabis stablemate Better in a deal worth US$35m in stock.

The deal, which was initially expected to be finalised by the start of Q3 2022, was set to see Intercure obtain Better’s commercial activities both in Israel and abroad, alongside its intellectual property, cultivation site and unique strains.

However, the deal soon fell apart, with Intercure announcing in February this year that it had officially been scrapped, and that it was owed around £1.5m in loans granted to Better during their negotiations, which it intended to recover ‘under all legal means available’.

Weeks later, Intercure launched a lawsuit against Better, which had reportedly ‘refused to repay’ its loans, seeking damages of around $30m over accusations it had ‘breached obligations’.

Now, Better is counter-suing, accusing Israel’s largest cannabis company of attempting to push competitors out of the market, and misrepresenting facts to acquisition companies.

“Better is asking the court for a number of remedies outlined in its lawsuit, as compensation for InterCure’s damages to Better during negotiations,” it said in a recent press release.

In response to the legal case, Intercure said that it ‘rejects all of Better’s allegations and claims contained therein’, and remains ‘committed to pursue any and all legal actions available to it to recover funds it has loaned to Better’.

Tikun Olam Cannbit

Elsewhere in Israel, Tikun Olam Cannbit is now set to be acquired by entrepreneur Ronan Elad, just weeks after it scrapped a merger deal with BOL Pharma.

Earlier this month, Business of Cannabis reported that a ‘memorandum of understanding’ was signed between Tikun Olam and BOL Pharma on April 3, 2023, which would have seen the companies combine to create a single new entity which would be traded on the Tel Aviv Stock Exchange.

Weeks later, on May 21, Tikun Olam announced that negotiations with BOL had now ended ‘without proceeding to sign a merger agreement’, thought to be due to the company considering activities outside of cannabis, and thus breaking the terms of the deal.

Now, according to Israeli Cannabis Magazine, Tikun Olam has signed a ‘binding but conditional’ agreement with Mr Elad and his group of companies will acquire a 60% stake in the company, while the existing shareholders will control the remaining 40% of the new company.

As part of the transaction, the newly combined company will continue to be traded on the Tel Aviv Stock Exchange, seeing Mr Elad’s business be traded publicly for the first time.

Furthermore, the agreement would require all current Tikun Olam company officials to be sacked.