Apollon Formularies

Aquis-listed Apollon Formularies has entered into another agreement to sell its ‘global assets’ after announcing that its previous deal with Global Hemp Group (GHG) had now fallen through.

In January this year, Apollon announced that it had signed a ‘binding letter of intent’ with GHG.

The deal, which continued in discussions until last month, would have seen Apollon receive $US250,000 in cash alongside 10m GHG shares in exchange for ‘exclusive licence to certain of Apollon’s international patent applications and proprietary intellectual property with supporting third-party pre-clinical test data in the following territories: The United States, Canada, and Mexico, as well as Israel and the European Union with extension to Morocco.’

In an announcement in early August, Apollon announced that the extensive negotiations had ultimately come to nothing, and ‘the disposal had been terminated by mutual consent’.

However, this week, Apollon announced that it has signed a new binding letter of intent with Canadian water-soluble cannabis solutions company Sproutly.

This will similarly see Sproutly acquire Apollons assets in exchange ‘a sufficient number of Sproutly shares so that Apollon will own 49% of the enlarged share capital’ post transaction.

The anticipated deemed price of CAD$0.02 (the price at which Sproutly shares were suspended), the effective valuation of Apollons assets would be CAD$7m (£4.2m).

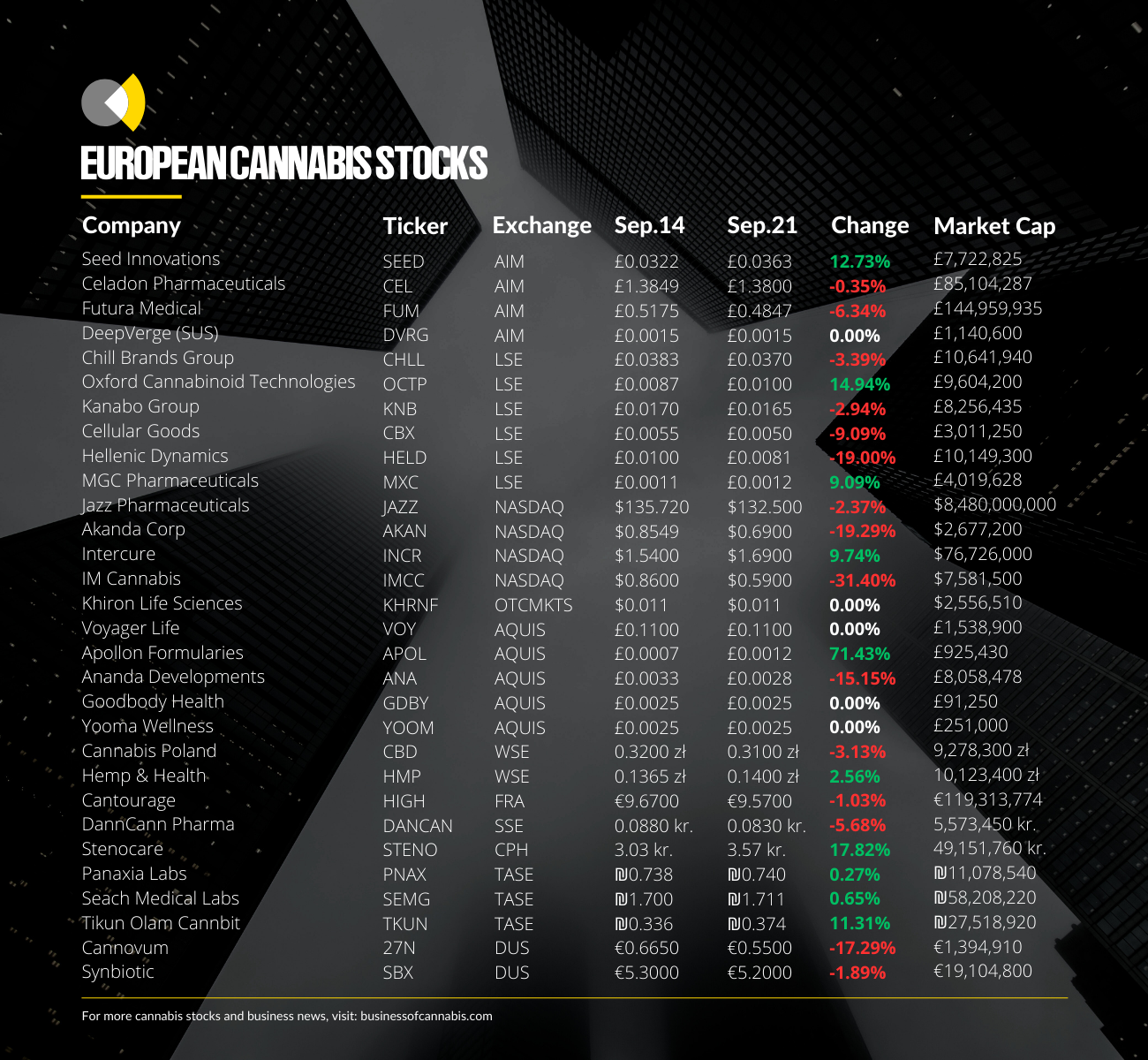

Apollon’s share price has increased over 70% since the news, as this valuation is around four times its current market capitalisation.

Stephen D. Barnhill, MD, Chairman and CEO of Apollon stated, “I am extremely pleased to proceed forward to complete this transaction for Sproutly to acquire Apollon’s assets. I believe the combination of assets currently held by the two companies will demonstrate that the whole is more than the sum of the parts.

Fresh Investment

The US Department of Health and Human Services’ (DHHS) recent recommendation, under the guidance of the Food and Drug Administration (FDA), that cannabis should be reclassified as a Schedule III drug is already encouraging positive investment activity in the sector.

Subversive Capital Advisor, which focuses on emerging sectors, this week launched a new cannabis- focused ETF, stating that a ‘regulatory move to Schedule III status meaningfully changes the trajectory for this business.

This fund will reportedly invest at least 80% of its net assets in companies directly involved in the global cannabis sector.

The Subversive Cannabis ETF is the company’s sixth fund, and comes as other ETFs such as AdvisorShares Pure US Cannabis and the Roundhill Cannabis have seen 25% jumps in value so far this month, according to Reuters.

Speaking to investment research company Zacks’ ‘ETF Spotlight’ podcast this week, founder and CIO of Seymour Asset Management Tim Seymour said that the ‘investment rationale for investing in this asset class is as strong as it’s ever been’.

He continued, that due to the performance of cannabis stocks over the past year, investors are able to grab stocks at a discount of around 30%-50%, and that ‘investors who are here today are coming in well ahead of a wall of institutional capital’.

Stenocare

Danish medical cannabis operator Stenocare has seen its stock price jump by nearly 20% this week after detailing a number of key initiatives it believes will see it ‘reach breakeven in 2024’ and become a ‘leading European brand for medical cannabis in Europe and beyond’.

The announcement, published earlier this week, laid out the company’s plan to ‘increase its ongoing flow of news stories and market updates’ in an effort to offer shareholders more detailed insights into its progress across various markets.

Following a period of ‘regulatory delays in Denmark and elsewhere’ the company says it is now seeing traction building in six key areas.

Firstly, in its home market, Stenocare is reportedly continuing to win market share thanks to a number of medical cannabis oils available through the country’s pilot programme.

According to the Danish Health authority, treatments with oil products have been growing since the introduction of Stenocare’s THC and CBD oil products.

“Specifically, when looking at quarterly growth of patients treated with oil-products and decline in patients treated with other products, it is a clear trend that full spectrum oil products are winning market share.”

Stenocare’s first oil product is set to be launched in the German market next month, while the company is also preparing to launch its UK Online Clinic for patients before the end of the year.

Alongside ‘progress’ in Norway, Sweden and Australia, Stenocare has also reportedly invested in development of a new oil-product called ‘Astrum Oil’, based on patented technology to which it owns the rights. This is expected to be ready for a first prototype by the end of 2023, with a view to supply the new product to patients during H1 2024.

Thomas Skovlund Schnegelsberg, founder and CEO comments: “I believe that with our range of initiatives across markets, existing and new products, a new groundbreaking technology that can and will take medical cannabis much closer to the pharma industry and our world class cultivation facility, we have the perfect basis for us to grow, reach breakeven in 2024 and also for us to emerge as a leading European brand for medical cannabis in Europe and beyond”.