The CCSI was assessed at C$5.01 per gram this week, up 0.9% from last week’s C$4.97 per gram. This week’s price equates to US$1,780 per pound at the current exchange rate.

Each week, Business of Cannabis delivers a series of insights from our partners at Cannabis Benchmarks®.

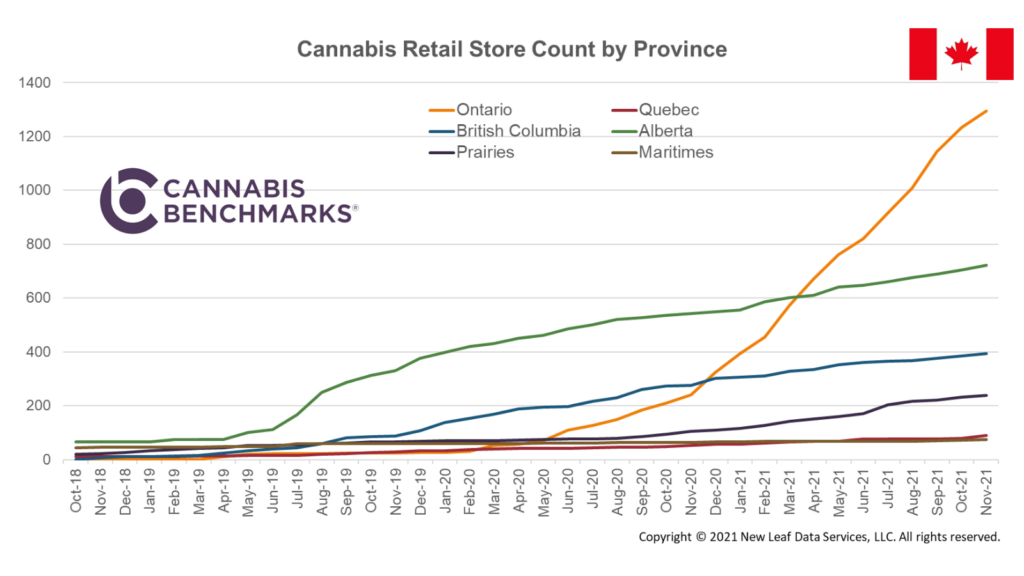

This week Cannabis Benchmarks provide an update on the increase in retail storefronts across Canada. As of November 30 we counted 2,810 licensed retailers, with an average monthly growth rate of 127 stores or 7% in 2021. Ontario took the lead last year, as the store licensing process eased and more applications were quickly approved. Since then, Ontario’s cannabis retail footprint exploded and the expansion has not slowed.

All other provinces, meanwhile, are still seeing steady growth but are also approaching a point of saturation. That being said, Ontario still has a lot further to go to reach the store concentration levels found in Alberta.

Cities in Alberta (Calgary, Edmonton, Red Deer, and Lethbridge) have the highest number of stores per capita – even more so than the big college towns in Ontario (Kingston, Waterloo/Kitchener, and London). With Alberta home to 721 stores, the competition is already quite fierce and there is a good likelihood that some stores will fail.

Major cities in British Columbia (Vancouver, Kamloops, and Kelowna) are big laggers, with many illegal stores still operating in densely-populated parts of the cities due to strong demand.

Quebec is in the worst shape with a relatively small number of stores, all provincially-owned. The small retail footprint of the legal market is leading to depressed sales in the province. If there was a change in the retail model, we would certainly see a jump in legal sales similar to the change we saw in Ontario after the rapid roll-out of stores that began in April 2020. At the moment, daily sales are hovering at around the same level as Alberta, a province with nearly half the population of Quebec.

Source: Canada Cannabis Spot Index, Cannabis Benchmarks

See previous weekly updates from Cannabis Benchmarks:

- A look at daily cannabis retail sales in Canada

- Legacy and legal cannabis sales three years after legalization?

- How to understand cannabis’ impact on alcohol sales in Canada

- Understanding cannabis retail store growth in Canada

- A look at average monthly spend per cannabis consumer

- A look at processing licenses issued by Health Canada

- A look at cultivation licenses issued by Health Canada

- Understanding medical versus recreational sales right now

- A look at daily cannabis sales by Province

- How to view dry cannabis sales across Canada

- A look at percentage of legal versus illicit cannabis sales

- A look at the pace of growth for cannabis retail

- A look at monthly cannabis sales in Ontario

- What is the optimal number of cannabis stores in Canada?

- How to compare daily cannabis retail sales by Province

- Understanding the impact of cannabis on alcohol sales in Canada

- A look at cannabis retail store count by Province

- A look at cannabis user statistics in Canada