As the cannabis industry continues to expand and evolve at pace throughout the globe, product testing is becoming an increasingly vital subsector.

While the sector is continuing to develop, both in terms of size and approach, its evolution is essential for the creation of a standardised, comprehensive, international regulatory framework which will enable the cannabis industry to flourish.

According to Prohibition Partners’ recently published Cannabis Testing Report, the cannabis testing market is thought to represent up to 0.64% of the total global cannabis market, and could be worth between $360m and $770m by 2027.

The global cannabis testing market

Although governments across the globe, particularly in North America, are working to establish a standardised model for testing cannabis products, there remains a lack of testing regulations specific to cannabis in many regions.

This is particularly true for testing consumer products such as CBD across Europe and the USA, where a lack of cannabis-specific regulation means equipment, methodologies and operating procedures are yet to be standardised.

Products like CBD oils are often inadequately tested, and insufficient regulation surrounding testing means a number of bad practices, such as ‘lab shopping’, continue to persist.

As for medical cannabis, testing in Europe is more stringent and detailed, but less harmonised across regions.

Furthermore, European medical cannabis testing requirements inform the requirements in other regions including Israel, Australia and Canada, despite it being a much more mature market.

Medical cannabis testing generally adheres to requirements for herbal drugs, covering different types of potential contamination, but fails to include cannabis-specific testing to determine things like terpene or cannabinoid content.

With many individual European countries seeking to revisit their regulations surrounding adult-use cannabis, there has been a notable increase in demand for high quality products, according to the report.

“Consequently, efforts are being made to harmonise regulations at the European level to ensure uniform and adequate quality control standards. Authorities are working to establish clear guidelines for the pro- duction, analysis and marketing of cannabis products to ensure consumer safety and product quality.”

In North America, where adult-use supply chains overlap with the medical market, common testing systems are also being developed for both product categories, a distinct departure from Europe’s concrete separation of the two categories.

Supply chains

The bulk of the cannabis-testing market serves business-facing clients, and cannabis companies generally follow one of two standard routes: in-house testing, or third-party testing.

Generally, larger medical and pharmaceutical cannabis producers will have in-house good manufacturing process (GMP) certified testing labs to test their products according to pharmacopoeial standards, though the majority of companies will still use third party testing labs for some forms of analysis to keep costs down.

In Europe, where the legalisation of medical cannabis and CBD has spread rapidly, the demand for cannabis-specific testing labs has followed in tandem, seeing many larger analytical testing facilities adopt services to serve the burgeoning market.

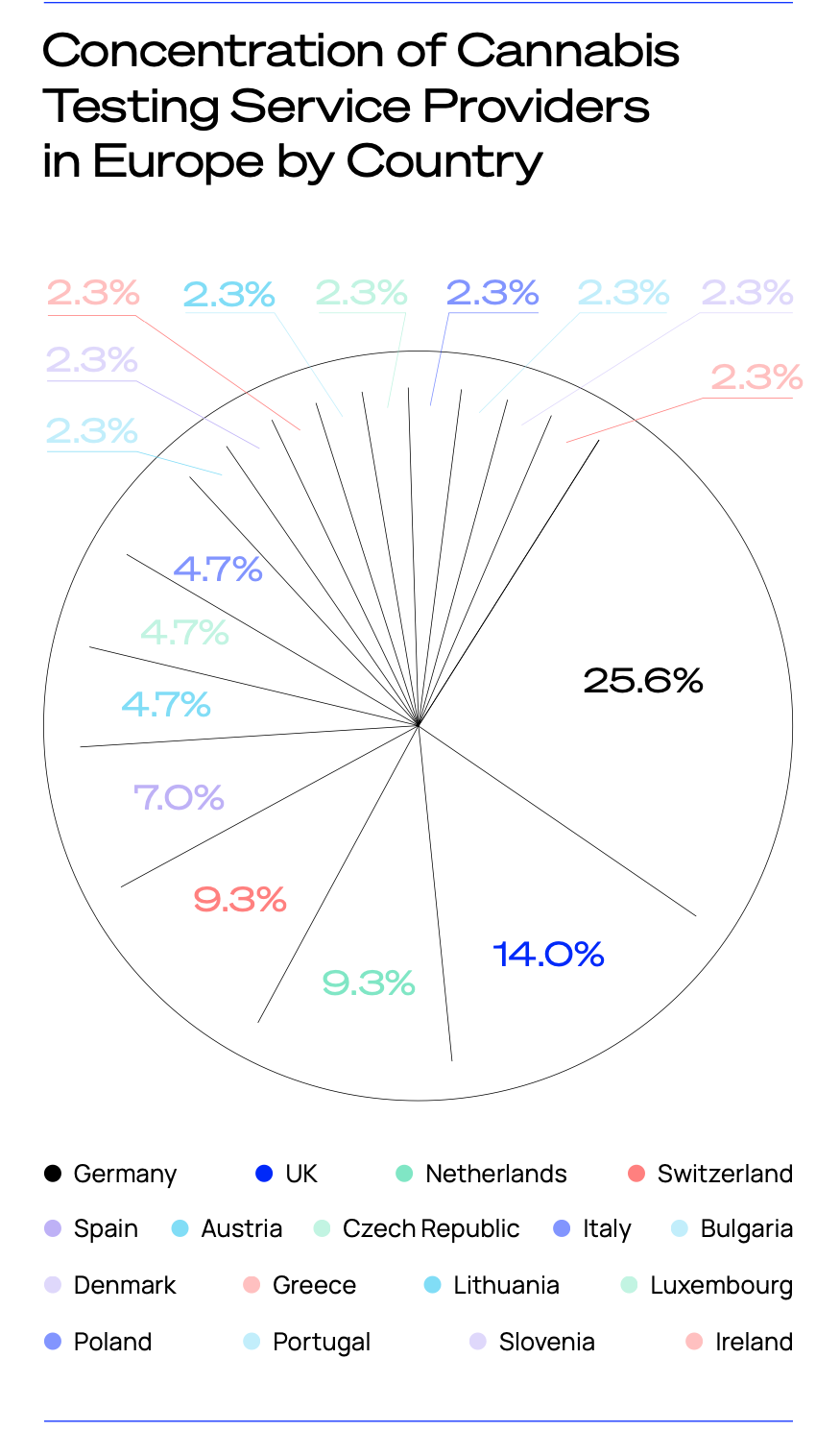

Over a quarter of the 43 organisations which provide cannabis-specific product testing services in Europe can be found in Germany, primarily due to it being the largest European medical cannabis market in terms of both sales and patient numbers.

This is also bolstered by a strong biotech market, which was understood to have been valued at €26.3bn in 2021.

Meanwhile, 14% of Europe’s cannabis testing facilities are situated in the UK, making it the second most concentrated country in the region.

However, these tend to focus far more on CBD testing services due to the prominence of the local market, whereas the German testing facilities seek to cover the pharmaceutical, medical and CBD sectors as they are predominantly larger, publicly held testing service providers.

The next largest markets are the Netherlands and Switzerland, both of which represent 9.8% of European facilities. The former consists of a mixture of providers offering services for the medical and pharmaceutical markets, though a significant number of these are targeted at the legally ‘grey’ adult use market.

Switzerland’s developed CBD market, which has defined CBD flower as a tobacco substitute and raised the legal THC threshold to 1% (higher than EU member states), means that the vast majority of its labs are focused mainly on the CBD market.

For more insight into the global cannabis testing market, download The Cannabis Testing Report here.