Germany’s highly anticipated CanG bill is now finally set to have its final reading in the Bundestag this week following months of doubt and delays.

Should the cannabis bill be passed as expected, the shape of Germany’s already flourishing medical cannabis market is set to change considerably.

While the highly anticipated removal of cannabis from the list of narcotics is widely expected to be a boon for medical cannabis operators, another key upcoming change has the potential to impact not only Germany’s thriving import and distribution market but also the lucrative international supply chains bringing medical cannabis into the country.

With CanG set to remove all restrictions on medical cannabis cultivation in Germany, a new wave of local growers could be about to disrupt this supply ecosystem.

Imports continue to rise

Under the current framework, while the cultivation of medical cannabis is allowed in Germany, it is highly restricted.

There is a tender process, under which just three companies, Demecan, Aurora and Aphria (owned by Tilray), are allowed licences to cultivate medical cannabis.

These licences cover a specific production quota, meaning there are strict limits on the strains and quantities that can be produced.

Meanwhile, Germany’s import market has been growing exponentially since 2017, and imported cannabis now represents an overwhelming majority of the medical cannabis available in the country.

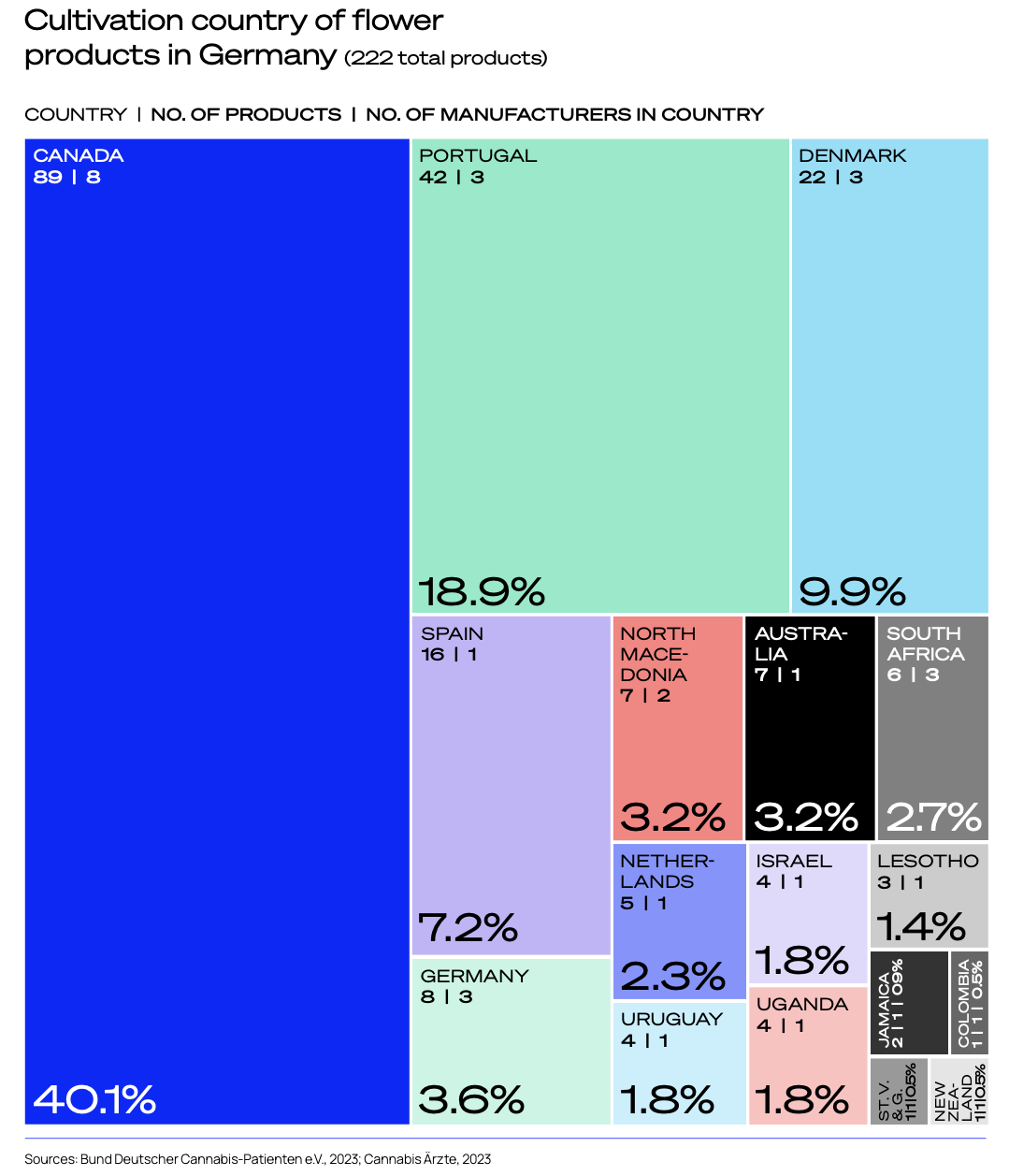

According to Prohibition Partners’ European Cannabis Report: 8th Edition, just 3.6% of the flower products available in Germany were produced there.

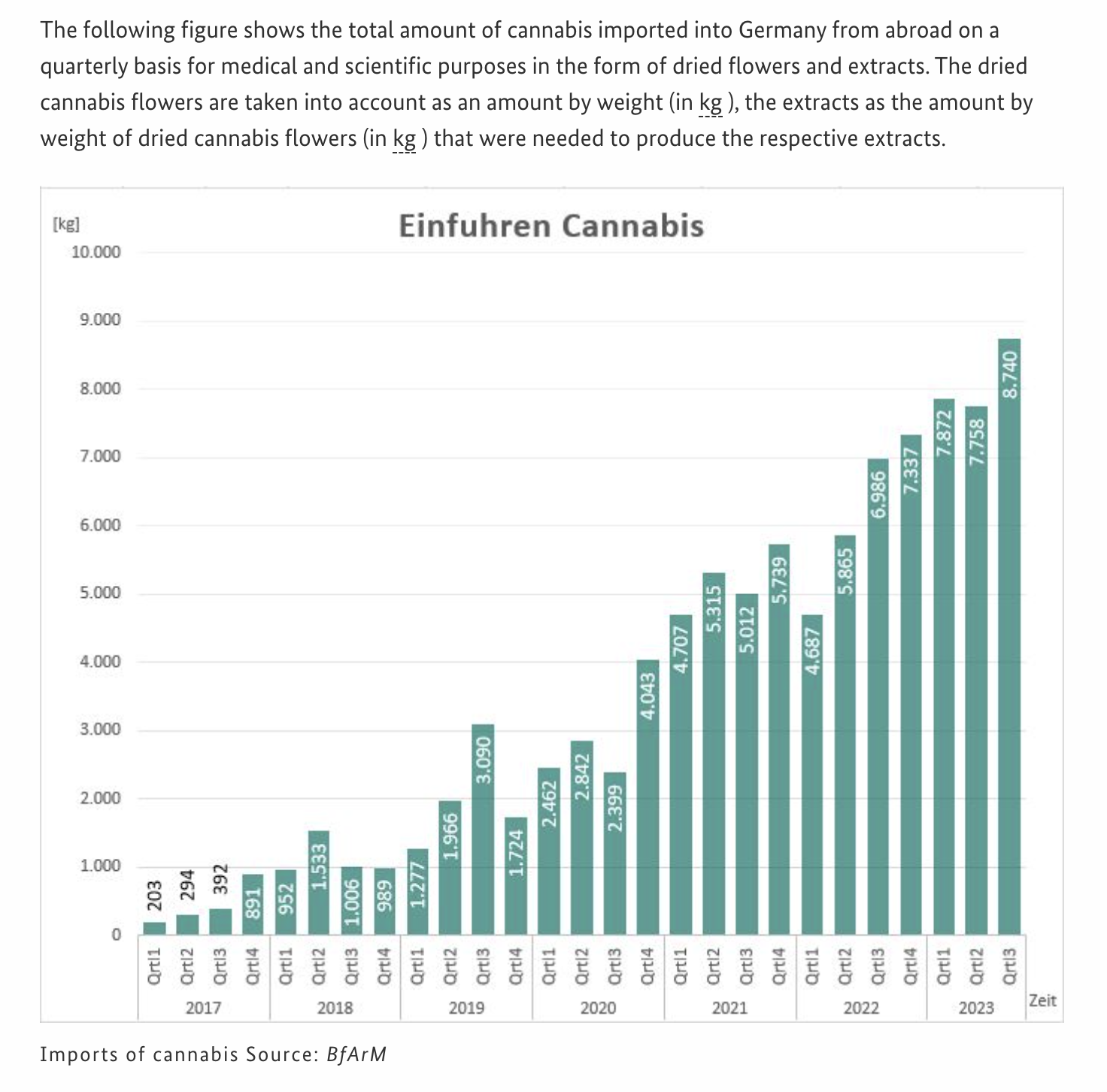

Furthermore, according to the latest figures from the Federal Institute for Drugs and Medical Devices (BfArM), the level of imports continued to rise late into 2023.

In Q3 of 2023, the total amount of cannabis imported into Germany was 8.74 tonnes, its highest level on record, up from 7.758 tonnes in Q2 and from 7.337 tonnes in the same period a year earlier.

Opening up of German cultivation

However, CanG could up-end this framework by removing the tender process entirely, along with all of the restrictions on domestic cannabis production.

In their comments on the CanG bill in October last year, the Bundesrat (Federal Council) raised the issue of German production.

“The Federal Council requests that the further legislative process examine the extent to which the legal framework conditions for optimising the supply of medical cannabis to patients can be improved.

“This concerns in particular the possibility of expanding the supply of medicinal cannabis in Germany by increasing or cancelling the national production quantities, the cancellation of the limitation of cultivation to certain varieties and the abolition of the cap on selling prices, in order to appropriately curb the sharp rise in imports of medicinal cannabis in favour of domestic production of the appropriate quality.”

Kai-Friedrich Niermann, cannabis lawyer and industry expert, explained to Business of Cannabis that the proposed removal of just two sentences stipulating that there must be a tender would achieve all of these goals.

This would mean any company could apply for a licence to cultivate in Germany, including foreign companies. Furthermore, there would no longer be any restrictions on the strain or quantity of cannabis grown, or the number of cultivation facilities allowed in Germany.

The German government itself expects this will see 100 medical cannabis cultivation facilities set up in the country.

How will this impact the market?

A number of sources have informed Business of Cannabis that this could see the emergence of another ‘green rush’ into Germany, similar to the international scramble to break into the market when its tender was first issued.

According to Klaus Madzia, CEO of Germany’s Cannovum Cannabis AG, this could put the incumbent German cultivators, already struggling to compete with the import market, in significant financial trouble.

“A lot more people can just convert their old warehouses and build GMP-compliant medicinal growing facilities. There’s going to be a lot of competition.”

Despite expecting an influx of investment in German cultivation operations, Mr Madzia remains sceptical about the financial potential of this opportunity.

“You’re just going to see a lot of people wasting money building up facilities and then getting burned in the market. I mean, basically you’re going to see destruction of capital… .There is a glut of medical cannabis in the German market. I mean, nobody is really waiting on German locally grown medicinal cannabis.”

Similarly, Bloomwell Group’s CEO and Co-Founder Niklas Kouparanis believes that German producers, saddled with higher labour and electricity costs, will struggle to compete with the cheaply produced and high quality imports already flooding the market.

“I expect it to be very challenging for German cultivators’ prices to compete with imports. It will take time and large investments to drive a boom in German medical cannabis cultivation, as investors don’t like asset-heavy investments in the cultivation space.

“The medical market in Germany is set to expand significantly thanks to the reclassification of cannabis as a non-narcotic. Still, we expect the increased demand for medical cannabis to be fulfilled mostly by imports – as is the case now.”

“Our top suppliers will likely remain in Canada and EU states like Portugal. Canada has provided over 6,000 kilograms of cannabis flower and extracts in 2021 alone. And with Germany’s medical market, which currently has between 200,000 and 300,000 medical patients, projected to see its number of medical cannabis patients multiply between seven and ten times, our country will need to remain an import-driven market.”

Yet, it’s not just prospective German cultivators who could be impacted by these new rules.

Under the UN Single Convention on Narcotic Drugs, every year countries are required to inform the International Narcotics Control Board (INCB) of their estimated quantities of psychotropic substances, including cannabis, required for medical and scientific purposes.

Part of this international law stipulates that, when a country’s domestic production ramps up, imports must be reduced. The INCB will grant import authorisations for the amount of medical cannabis that cannot be fulfilled via domestic production.

Regardless of whether German domestic production is profitable, the coming spike in German production could significantly impact the amount of medical cannabis that can be imported into Germany under international law, impacting a lucrative supply chain that spans the globe.