IM Cannabis

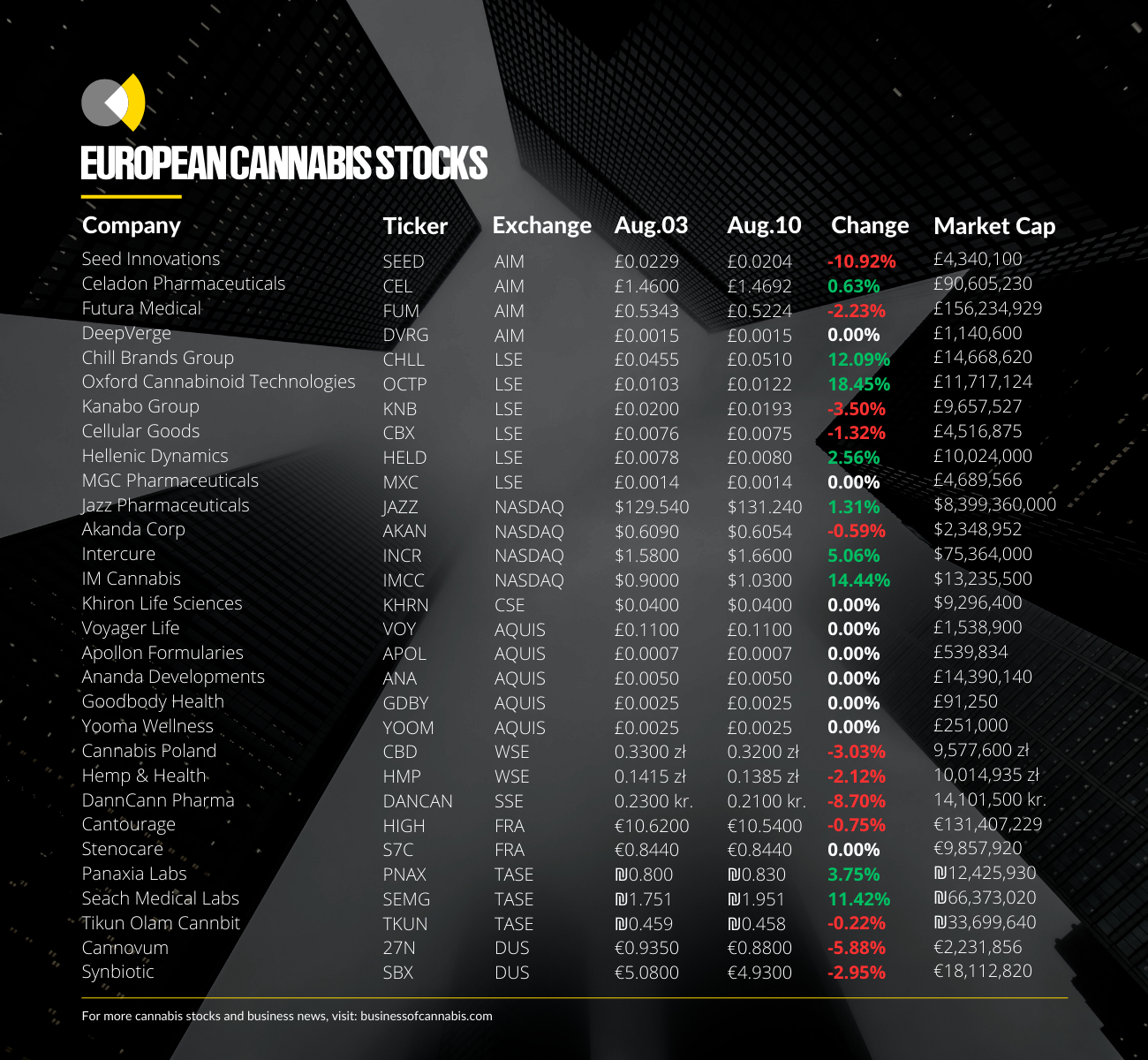

International medical cannabis operator IM Cannabis has now received its second warning from NASDAQ regarding its share price, months after pushing through a share price consolidation to remain on the exchange.

Last week IM Cannabis, which now operates in Israel and Germany, received a written warning from the exchange that it ‘is not in compliance with the minimum bid brice requirements’.

It comes as IM Cannabis’ stock price fell below $1 in June and remained below the minimum threshold for over 30 days.

In order to prevent being delisted, it has until January 31, 2023 to bring its share price back above $1 for ten consecutive days.

Business of Cannabis reported last July that IM Cannabis had received its first minimum bid price warning from NASDAQ, with the company forced to resort to a 1:10 reverse stock split in November force its share price back above the threshold.

Like its NASDAQ stablemate Akanda, which also resorted to a reverse stock split to artificially boost its share price and remain listed, its value has continued to decline ever since, leaving both companies facing the prospect of delisting a second time.

Unlike Akanda however, IM Cannabis may benefit from positive investor sentiment towards Israeli cannabis operators over the past week, which has seen a number of local operators’ share prices spike (as reported below).

At the time of writing, IM Cannabis’ share price is sitting just below $1, falling from a high of $1.03 last week.

Aside from external regulatory changes driving up Israeli cannabis stock prices, IM Cannabis is also engaged in an ongoing cost cutting drive which has already seen it pull out of Canada, and may yet help encourage more positive sentiment from investors.

In May, following the release of its first quarter results, which revealed a number of significant cost reductions, its stock jumped 30% coming back above the $1 threshold for the first time since February.

If IM Cannabis is able to repeat this in its second quarter results, set to be released next week (August 14), it may be able to stave off the threat of delisting a while longer.

Israeli Cannabis Stocks

A number of Israeli Cannabis stocks shot up this week following the release of new proposed amendments to the country’s medical cannabis framework which could significantly increase patient numbers.

On Monday (August 07), The Health Ministry published its highly anticipated proposals for medical cannabis reform in Israel, which aim to significantly reduce the scope of regulation on medical cannabis businesses and patients, reduce costs and promote research and development.

Business of Cannabis will be delving deeper into these reforms, and their potential impacts in the coming days.

On the day following their publication, Israel’s largest cannabis operator Intercure saw its NASDAQ-listed stock spike as much as 11% to $1.70, bringing it out of historic lows, though it has since fallen back to around $1.60 at the time of writing.

Elsewhere, Panaxia Labs also saw its stock price increase around 4% this week, following a much steeper rise of nearly 18% in the previous week, likely in anticipation of the sweeping reforms, many of which were leaked before publication.

This was also true of Seach Medical Labs, which saw an increase of around 11% this week off the back of a 10% increase in the week previous.

Similarly Tikun Olam Cannbit, which saw a slight decline of around 0.22% this week, saw the most significant increase of over 40% last week.

It will come as a welcome relief for the Israeli cannabis industry which has seen stock prices struggle to break from an ongoing downward trend over the past year, with a growing list of companies either verging on bankruptcy or announcing their diversification away from the cannabis industry.

Cannovum Cannabis AG

Cannovum Cannabis AG, a German listed company now focusing on the country’s upcoming adult-use market, announced another key addition to its Cultivation Alliance this week.

On Monday August 7, Cannovum announced that it has welcomed ‘high end cannabis social club’ Chillisimo to the ranks of its Cultivation Alliance, marking the latest in a string of additions over the past two months.

As part of the new collaboration, Cannovum Cannabis AG and its Cultivation Alliance will develop exclusive products with and for Chillisimo, which is understood to be establishing clubs in Ansbach, Berlin, Erlangen, Herzogenaurach, Munich, Nuremberg, Stuttgart and Würzburg, ‘with more cities to follow soon’.

“As a preferred partner of Chillisimo, we are demonstrating the potential and revenue opportunities of cannabis legalisation in Germany,” said Klaus Madzia, CEO of Cannovum Cannabis AG.

“According to our calculations, a single club in Germany can turn over up to 2.4 million euros per year with cannabis. We expect several thousand clubs in Germany in the medium term.”

While Cannovum’s stock dipped by around 5% this week, it came off the back of a 30% increase the week prior.