InterCure

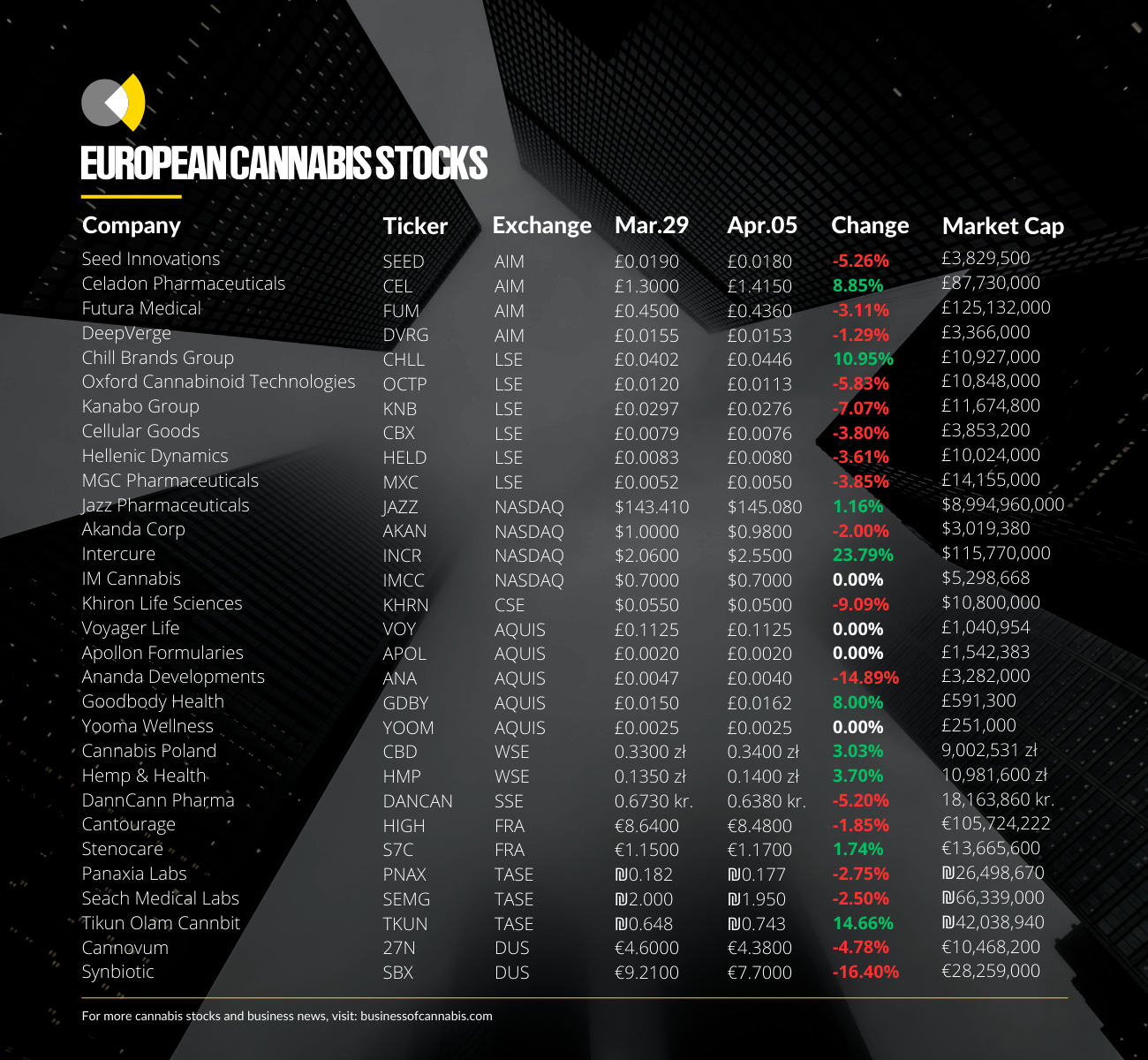

InterCure has continued its blistering run of financial performance after revealing another record quarter over the weekend, ‘solidifying (its) leading position’ over its Israeli competitors and sending its stock up over 20%.

For the three months ended December 31, InterCure reported revenues of $41m, representing a 5% increase on the previous quarter, and a 33% increase on the same period a year earlier.

It also represented the fourth quarter of record sales in 2022, following four consecutive quarters of record growth throughout 2021 also.

This meant revenues for the full year in 2022 hit $150m, significantly higher than the $85m it reported in 2021.

In Q4, InterCure reported gross profits of $14m, with margins dropping from 44% in Q3 to 35%, which it attributed to ‘financially struggling companies’ selling lower quality products at discounted prices in an effort to liquidate their inventories. Meanwhile Q4 EBITDA came in at $7m, around 18% of revenues.

Over the full year, its profit margins seemed to have been more favourable, with gross profits coming in at $61m, a margin of 41%, and EBITDA coming in at $32m, around 22% of revenues.

Notably, InterCure said it loaned over $20m to other cannabis companies as part of ‘uncompleted mergers and acquisitions’ throughout 2022. While Better and Cantek are well-publicised examples, another two undisclosed companies are also included in the document.

According to the Israeli Cannabis Magazine, at its current revenue rate it’s likely that InterCure has all but run out of room to grow in its domestic market, making future growth much more reliant on its relatively new international operations.

In Q4, InterCure announced an expansion of its partnership with US luxury cannabis brand Binske that will see it ‘develop and offer a range of non-flower cannabis products, which we believe will significantly enhance our product portfolio and further strengthen our market position’.

InterCure CEO Alexander Rabinovich added, “As our target markets are evolving, we remain focused on execution with financial discipline while navigating through regulatory barriers and market challenges.

“While favourable regulatory cannabis reforms are on the horizon, we expect our growth journey to continue as we remain focused and committed to expand our leading platform, building shareholder value and improving quality of life for patient communities across the world.”

It comes as the majority of the rest of the Israeli cannabis market continues to struggle, with not one company other than InterCure and Seach reporting profits.

In fact, as Israeli Cannabis Magazine reports, the collective losses of all the listed loss-making Israeli cannabis companies came in at nearly $70m last year.

Chill Brands

CBD retailer Chill Brands has secured a further £2.6m ‘from a high net worth investor’, seeing its shares continue their upward trend this year, recovering from historic lows in 2022.

The newly secured cash marks the second successful fundraise in less than a month, after the company announced it had secured a smaller £560k investment from a ‘financial institution’ following the ‘receipt of an unsolicited offer’.

Among the £3m plus in fundraising, Chill Brands also announced the launch of its nicotine-free vapour products in the US, after receiving a purchase order from a Florida distributor representing a ‘significant proportion’ of its existing inventory.

According to the company, these products are ‘under consideration by numerous retail buyers in the US’.

It also says that the funds raised over the last month will go towards the ‘development and production’ of its new vapour products, as it expects to have sold its entire first production run already, ‘subject to confirmation of final purchase orders’.

This run of news has seen Chill Brand’s share price increase by around 20% since the end of March to 4.45p at the time of writing.

The company’s CEO Callum Sommerton said: “We are thrilled to have secured funding from a new long-term investor. This will provide us with the resources needed to expand both on our product output and the marketing activities that will help us to deliver those products to a wider audience of retailers and consumers.

“The past 18 months have been exceptionally difficult for the Company and its CBD industry peers, but Chill Brands is now diversified and on course to expand its product distribution platform.”

Akanda

Akanda announced last week that it had received confirmation from NASDAQ’s Listing Qualifications Department that it has officially regained compliance with its minimum bid price requirements.

However, since the announcement, its share price has fallen back below the $1 threshold, meaning that it is once again under threat of being delisted from the stock exchange.

Business of Cannabis reported last month that Akanda had successfully implemented a 1-for-10 reverse stock split on its ordinary shares, seeing Akanda’s share price jump from $0.19 pre-consolidation to around $1.42 when trading restarted.

It came after Akanda announced that it had received notification from the Listing Qualifications Department warning that it was ‘not in compliance with the minimum bid price requirement’.

Under NASDAQ’s listing rules, securities are required to ‘maintain a minimum bid price of $1 per share’, and should share prices remain below this threshold for ‘30 consecutive days’, companies face being delisted.

In a press release published last week, Akanda said: “According to the Notification Letter on Compliance, the staff of Nasdaq has determined that for the last 12 consecutive business days, from March 9 to March 24, 2023, the closing bid price of the Company’s Common Shares has been at $1.00 per share or greater. Accordingly, the Company has regained compliance with Listing Rule 5550(a)(2) and the matter has been closed.”

On March 29, when this statement was published, Akanda’s share price stood at $1.00, but has since continued its decline and sits at $0.98. Should it not recover by May, Akanda is likely to have to once again fight for its survival on the NASDAQ.

Elsewhere, Halo Collective, Akanda’s largest shareholder, announced this week that it has not met its filing deadline for its audited annual financial statements and that a management cease trade order (MCTO) has been granted by the Ontario Securities Commission.

An MCTO is used when a company’s management is unable to provide timely financial statements, such as quarterly or annual reports, due to financial difficulties or other reasons.

The MCTO restricts trading in the company’s securities by management and insiders, but allows trading by other investors. This means that the company’s management and insiders are not allowed to buy or sell the company’s securities until the MCTO is lifted.

The MCTO provides a temporary solution for the company to work on resolving its financial reporting issues while still allowing other investors to trade in the company’s securities. Once the company has resolved its financial reporting issues and the required financial statements have been filed, the MCTO can be lifted, and trading by management and insiders can resume.