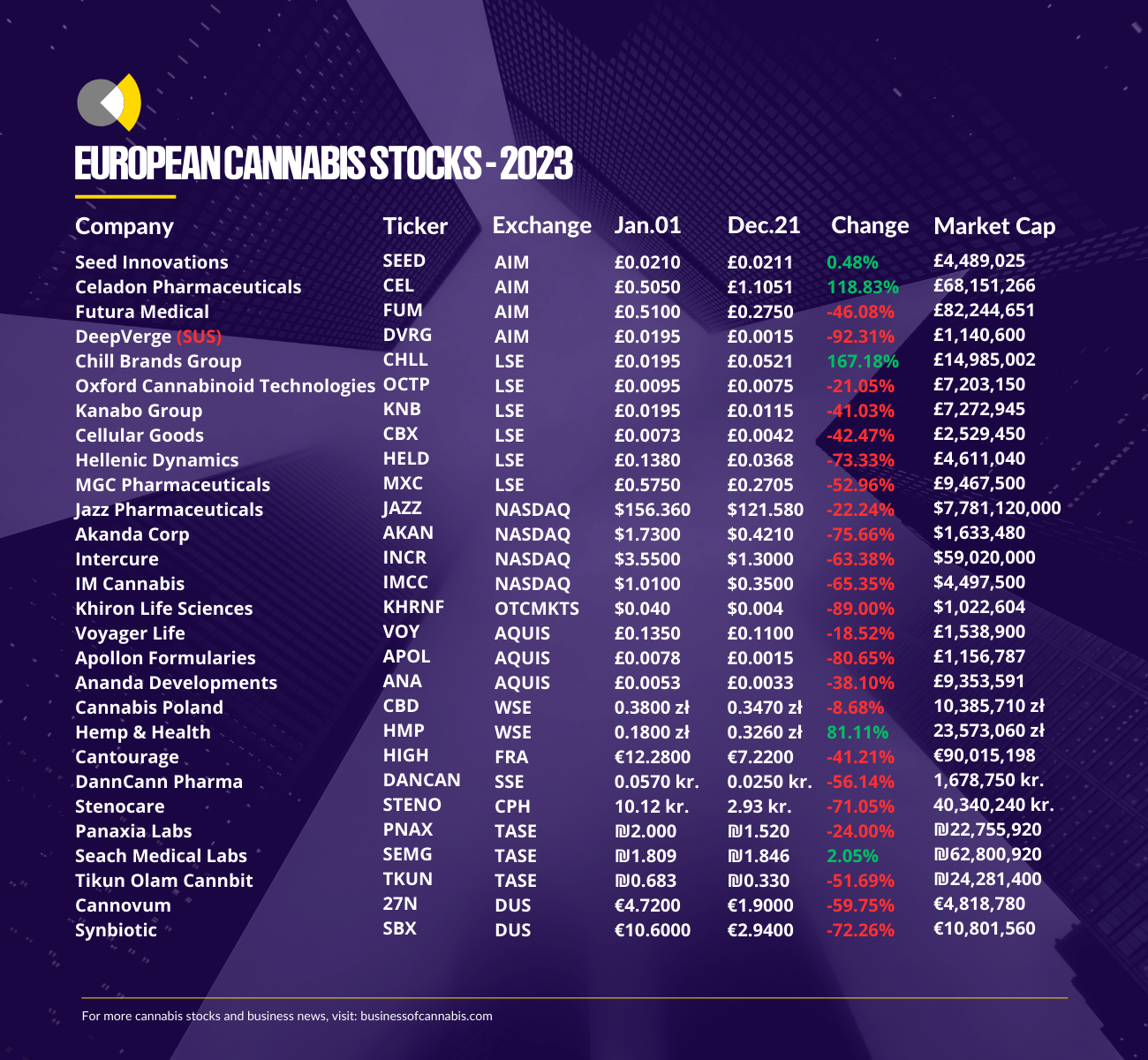

European cannabis stocks in 2023

2023 has been perhaps the hardest financial year to date for the emerging European cannabis sector. Two European wars, an ongoing energy and cost of living crisis, and continued poor sentiment towards cannabis investments have meant access to funding has been incredibly hard to find for the majority of firms.

With stock prices continuing to decline on the whole throughout the year, with a few notable exceptions, 2023 has seen a renewed focus on financial management for many, with investors increasingly favouring companies who are able to turn a profit.

The continued share price depression has seen the likes of MGC Pharmaceuticals, Hellenic Dynamics, Akanda and IM Cannabis (late last year) turn to share price consolidations to boost their value.

It has also seen Europe’s two remaining cannabis-focused ETFs, HanETF’s Medical Cannabis and Wellness UCITS ETF (CBDX) fund and The Rize Medical Cannabis and Life Sciences UCITS ETF (FLWR), either be folded into other funds or be scrapped altogether, as they have become ‘no longer viable’.

Lack of meaningful regulatory progress in areas like CBD have also impacted companies this year, most recently seeing Yooma Wellness file for bankruptcy, and its CBD rival Love Hemp collapse earlier this year.

However, this consolidation has been widely expected following the Green Rush of 2021. A number of investors and stakeholders have informed Business of Cannabis that not only does this present numerous attractively priced M&A propositions, but the grounding of valuations make investment a much easier prospect for institutional players.

With plenty of positive regulatory progress also being made in some of Europe’s largest markets throughout the year, many are looking to 2024 with optimism.

MGC Pharmaceuticals

Earlier this week, MGC Pharmaceuticals announced that its proprietary COVID-19 treatment ArtemiC has been approved for use in the Kingdom of Saudi Arabia.

Following Phase II clinical trials and European studies on the product’s effectiveness, the Saudi Food and Drug Authority (FDA) have approved the product as an ‘over-the-counter’ dietary supplement’.

While the company’s CEO Roby Zomer said the was ‘delighted to receive Saudi FDA approval’, it does not yet have any commercial deals lined up in the region.

“We are hopeful this will materialise into commercial orders for MGC as we work closely with Capital Blossom Ltd who are specialists in this territory,” he added.

In July, MGC Pharmaceuticals announced that it had received a second purchase order for its proprietary ArtemiC product from AMC Pharma, once again totalling $1m for 100,000 units.

Hellenic Dynamics

Hellenic Dynamics Plc has recently inked a five-year Memorandum of Understanding (MOU) with The University of Patras in Greece.

The collaboration is set to pave the way for joint scientific research projects between Hellenic and the Laboratory of Molecular Pharmacology, Department of Pharmacy at the university.

Under the MOU’s terms, the focus of the collaborative efforts will center around cannabis-based molecules, with the ultimate goal of conducting clinical trials. The intention is to cultivate cannabis plants specifically tailored for use by major pharmaceutical companies.

Davinder Rai, CEO of Hellenic Dynamics, commented: “The Laboratory of Molecular Pharmacology at The University of Patras is well known for its advanced research into cancer and into medical cannabis.

“It is intended that the partnership with The University of Patras will allow Hellenic Dynamics to register for IP protection on specific strains of medical cannabis that its partners may wish to conduct clinical trials with. Any successful molecule wholesale production will be handled by the Company.”

Panaxia Labs Israel

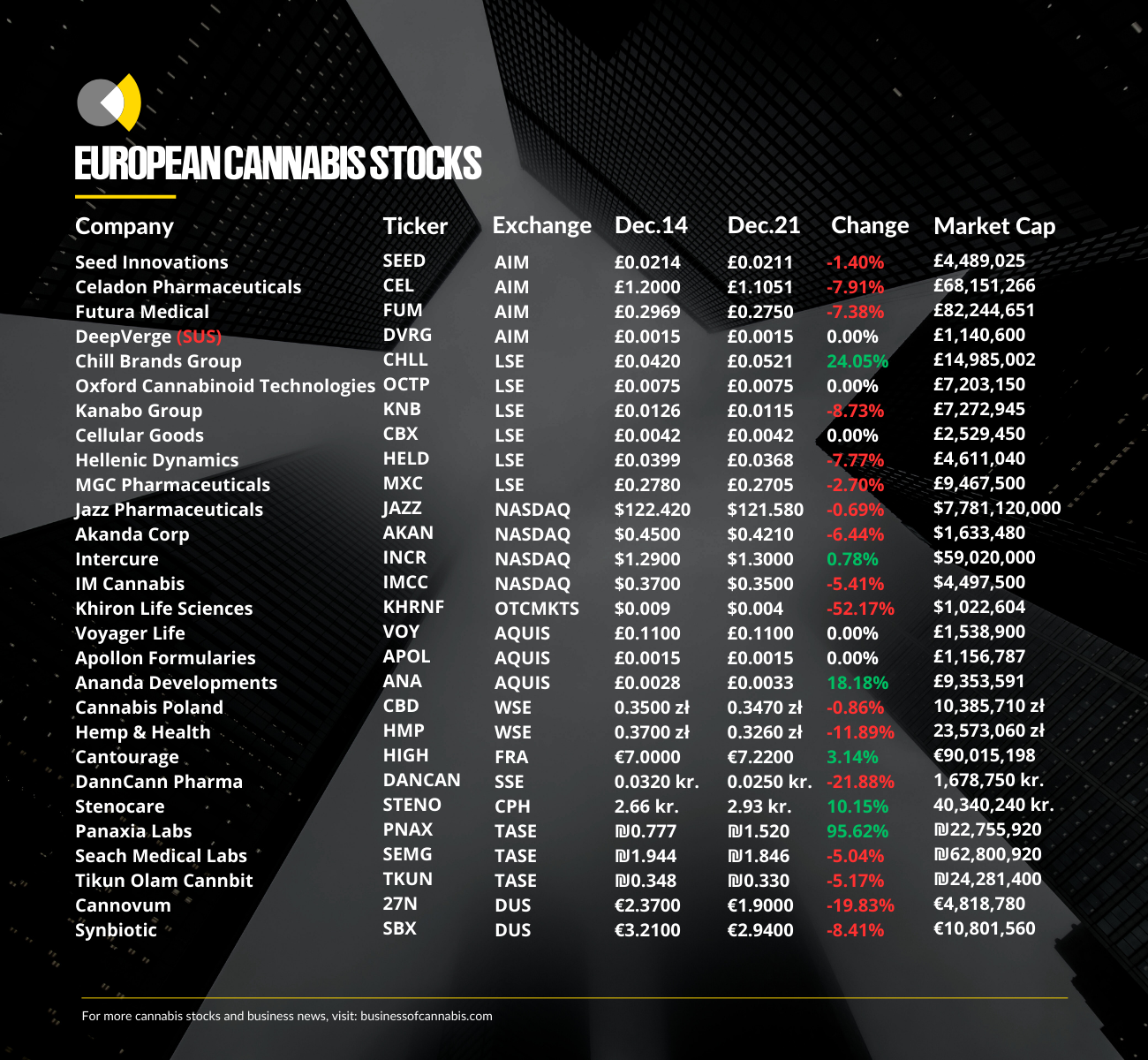

Panaxia Labs has seen a huge boost to its stock price this week after it updated investors regarding its upcoming merger with the Barak Group.

The company said it was ‘actively reducing expenses associated with its medical cannabis operations’ in preparation for the integration of Barak Group’s activites.

Additionally, the company reports the extension of the final merger date to complete the transaction, including all its conditions and components, is set for April 30, 2024. The merger agreement’s remaining terms will remain unchanged.

Furthermore, the company announced the termination of a lease agreement for its Lod property housing its medical cannabis production facility, which is now expected to be vacated in the coming week.

According to the proposed agreement, Panaxia would sell its operations to the current controlling shareholder, and it would enter into an agreement to bring in the operations of the Barak Group, in consideration of the allocation of 60% of Panaxia’s shares.