Akanda

Akanda was one of a number of major European cannabis firms to release financial figures this week, days before announcing that it had secured a new ‘short-term’ $500k loan.

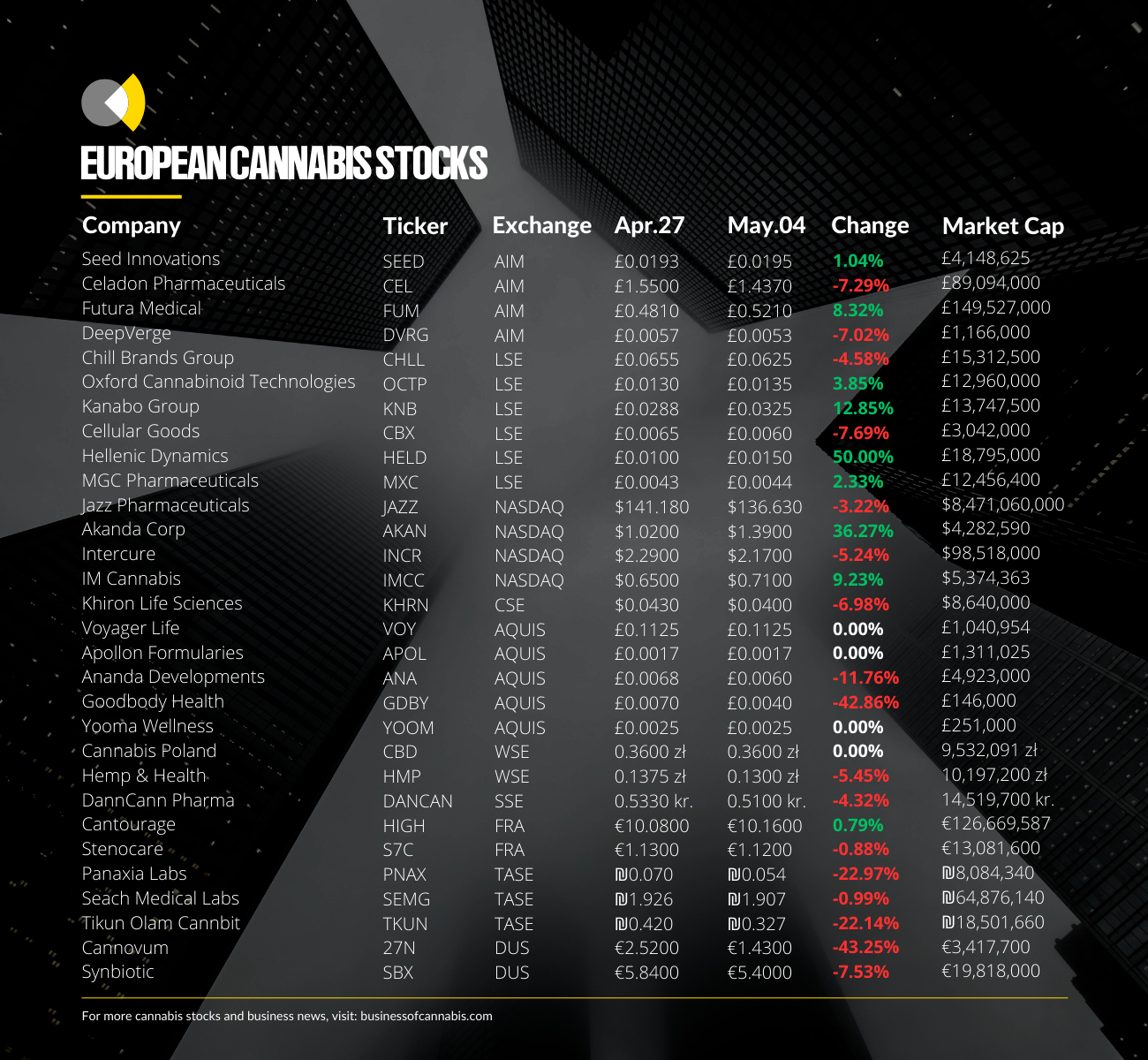

The NASDAQ-listed cannabis cultivator, manufacturer and distributor saw its stock price jump by over 36% this week, thanks in large part to a dramatic increase in revenue growth for 2022 of over 6000%.

According to its FY 2022 earnings report, submitted to the SEC on May 02, 2023, Akanda’s revenues topped $2.6m in the year, up from just $41.4k in 2021.

Almost all of this revenue increase came from RPK Biopharma Unipessoal, which is indirectly held by Akanda through Holigen Limited, which reported sales of $1.9m over the period.

Canmart generated $101.7k, up from $41k in 2021, while Bophelo ‘made only one sale of cannabis flower to a local buyer in April 2022 and generated sales revenue of $31k’, but has since been placed into insolvency.

Despite the increase in revenues, Akanda also saw a considerable spike in operating losses, rising from $2.6m in 2021 to $20m last year ‘primarily as a result of the costs of listing, as well as increased operating expenses to execute our business plan and growth strategy.

It did however report a gross profit of $3.3m, up from a loss of $1.5m year-on-year.

As of December 31 2022, Akanda reported cash equivalents of $255k, down from $3.5m in 2021.

In an effort to provide some more runway, the company announced on May 04 that it had secured a short-term $500k loan from Veridia Canada.

The loan, which is not interest bearing if it is repaid within 90 days, is secured by the ‘existing inventory and equipment, accounts receivable and purchase orders’ of the groups only revenue generated subsidiary RPK.

Katharyn Field, Interim Chief Executive Officer of Akanda, commented: “This short-term loan provides us with the flexibility needed to continue the implementation of our strategic plan while continuing to evaluate longer-term financing options.”

MGC Pharmaceuticals

Following a brief quarterly financial update last week, MGC Pharmaceuticals announced that it had secured EU-GMP certification for its ‘fully automated, large scale production facility’ in Malta.

The facility, which was built with the support of an 80% EU cash funded grant from Malta Enterprises and commissioned in 2022, will reportedly be able to produce over 20,000 units a day (over 6,000,000 units a year) of MGC’s medicines and ‘fulfil all future commercial manufacturing needs of the company in house’.

Furthermore, the facility will now open up a ‘new potential revenue stream’ for MGC, enabling it to create third party production services for other companies.

MGC’s Managing Director Roby Zomer said: “The formal grant of EU-GMP certification for the Malta facility is a major milestone for the company today, and further enhances the MGC production capabilities for its future expansion, guaranteeing its ability to supply large volumes of its products to its customers and distribution partners of high pharma standards, and quality into the future.”

Days earlier, MGC published a quarterly update for the three months to March 31, 2023, revealing ‘receipts from customers’ of A$567k.

It ended the period with cash and cash equivalents of A$315k, down from A$1.1m at the start of the quarter.

However, post quarter the company successfully raised an aggregated £2.09 million (A$3.82m) by way of a conditional placing supported by a mix of new and existing institutional and high net worth shareholders in both the UK and Australia.

Mr Zomer said that the company’s ‘clinical trial pathway and pipeline’, which aims to see its two key products CimetrA and ArtemiC approved by the US FDA, were ‘major catalysts in the fundraise’.

Cellular Goods

The LSE-listed CBD retailer also published its interim results today, revealing a 140% revenue increase and a reduction in operating losses.

In the six months to February 28 Cellular Goods reported sales of £31k, up from what it described as a ‘low base’ of £13k in the prior period.

In an effort to stem its losses and cash burn, the company said it has ‘implemented a major rationalisation programme’, apparently reducing its cost base by £3.2m, but incurring a one-off cost of £570k.

Despite this, it still reported an operating loss of £1.81m, though this was down by 25% on the previous period.

As of March 31 2023, Cellular Goods reported £2.5m in ‘net cash’, down from £4.47 as at August 31, 2022.

Although the company’s proposed tie-up with Cannaray was ultimately scrapped earlier this year, the company said it is ‘continuing to assess strategic opportunities to generate long term shareholder value and is open to consider proposals which deliver value and accelerate the development of the business’, which included areas ‘beyond cannabinoids’.

Commenting on the results in a statement, Cellular Goods chairman Darcy Taylor said: “Despite industry headwinds, we have benefitted from a positive sales momentum in the first half that has continued into the second half. In combination with a significant rationalisation of our cost base and cash burn, we have defined a path to drive our brand business forward.

“We are continuing to assess strategic opportunities to deliver long-term shareholder value and will assess each opportunity on its merits. In the meantime, our focus will continue to be to execute the company’s existing business model and position it for long-term growth.