4C LABS has announced a new tie-up with Canadian cannabis producer BZAM, which will see it import 1,200 kg of medical cannabis into the UK over the next two years.

The UK-based company, which operates its own 55,000 sq. ft growing facility in Guernsey, believes the deal will enable it to establish a ‘dominant’ foothold in the developing UK market.

Beyond this, however, 4C Labs suggests the tie-up represents the ‘front end of the wedge’ for a new and vastly improved influx of medical cannabis imports from a ‘new wave’ of Canadian producers.

“These products will address the demands of UK medical cannabis consumers for better-priced products with improved quality,” Greg Dobbin, 4C Labs CEO told Business of Cannabis.

The deal

Canadian Securities Exchange-listed BZAM, which has a current market value of just under C$40m, announced the launch of the deal last week.

Under the terms of the ‘strategic distribution agreement’, BZAM’s subsidiary The Green Organic Dutchman (TGOD) has promised to supply 4C Labs with 600 kg of flower annually for the next two years.

TGOD’s EU GMP product will reportedly be the ‘first of many new market-proven products to be launched by 4C Labs in the UK’ in the final quarter of this year, after it successfully secured its Importation and Distribution licences from the UK Medicines and Healthcare products Regulatory Agency (MHRA) in September last year.

Mr Dobbin believes that this newly secured supply deal will enable his company to address many of the issues currently dogging the UK’s medical cannabis industry, namely poor-quality product, inconsistent supply and unaffordable prices.

He explained that, in his view, many of these issues can be attributed to mistakes made by the first wave of major Canadian cannabis producers such as Canopy Growth, Aurora, Tilray, Hexo and Aphria.

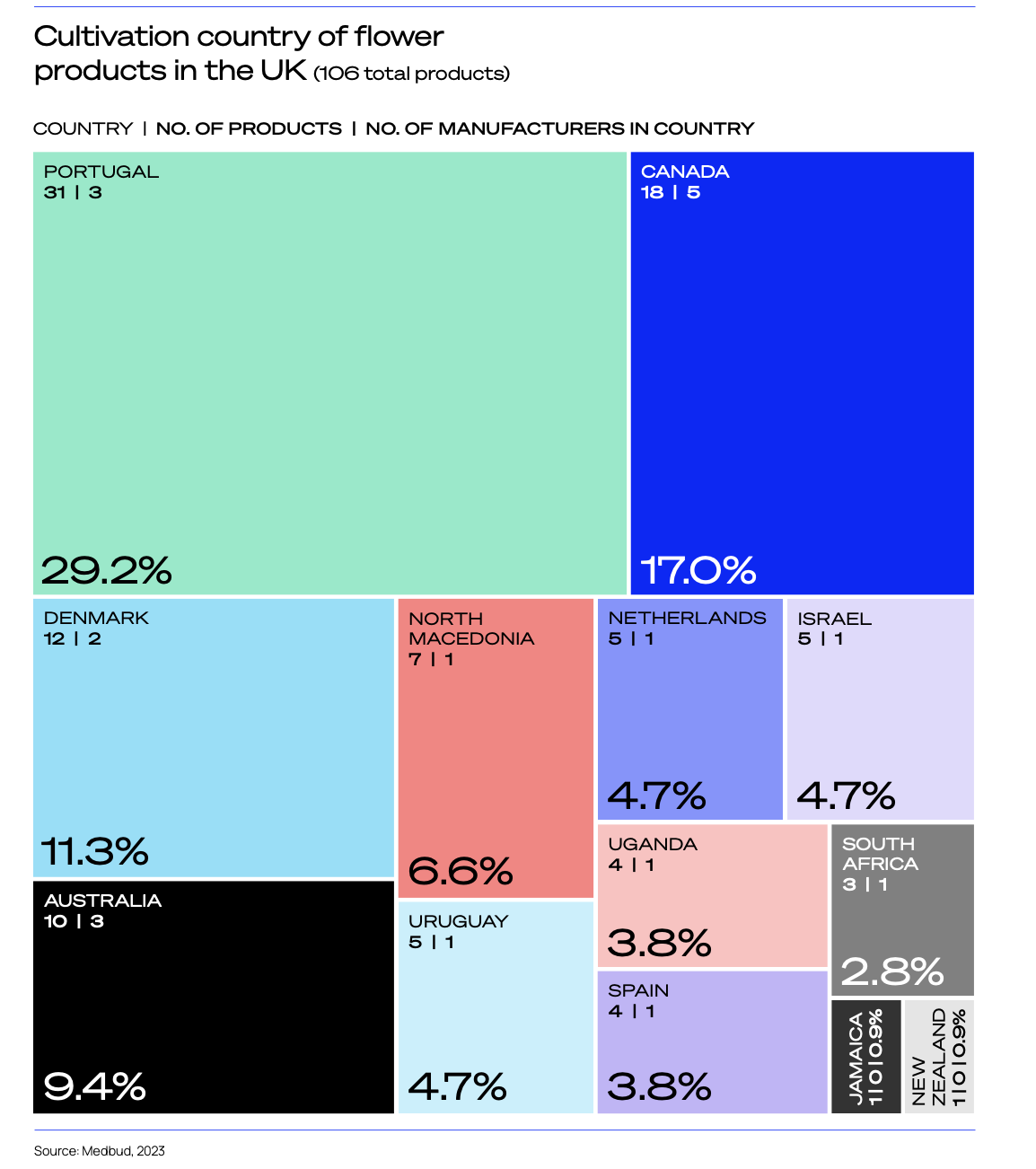

While Canada’s supply chain dominance has been chipped away since 2018, according to Prohibition Partners’ latest European Cannabis Report it still represents the second largest supplier of flower to the UK.

“When the original Canadian companies came into the world, they were given boatloads of cash, and basically had no idea what they were doing in terms of how to grow. They were given a window to purchase genetics, so they went to the internet, they went to the grey market, and they purchased unstabilised genetics,” Mr Dobbin said.

He went on to say that this resulted in these companies producing large amounts of poor-quality product, which they struggled to sell locally due to the strength of the illicit market. As such, they began exporting this flower as medical cannabis to the UK and Germany as ‘an afterthought’.

Furthermore, due to these companies’ current cash crunch crises, he believes these companies are ‘unfortunately doomed by their original strategy and will have a hard time recovering’.

New wave of cannabis producers

This first wave of dominant Canadian players look to be on a steep downwards slope, with almost all continuing to contend with hundreds of millions in annual losses, and the domestic market share of the top ten licensed producers dropping from 75% in 2021 to around 60% at the end of 2022.

Meanwhile, a swathe of Canadian companies ‘that were not as early to the party and were undercapitalised’ have been quietly building their genetic profile and developing a range of products that ‘resonate with people’.

Mr Dobbin suggested that these companies, including BZAM, TGOD, Organigram, Pure Sunfarms and Decibel, are now flooding the market with low-cost premium products.

With Canadian wholesale prices remaining low, and excise taxes failing to shift despite ongoing calls from the industry, this new wave of companies is now also looking to the UK and Europe to subsidise their incomes.

Through these new supply routes, 4C Labs hoped to be able to ‘undercut both the illicit market and medical market by 40%’, while outdoing both on quality.

“When I talk about the front end of the wedge, I think we’re finally seeing companies that have drilled down to try and understand how to make products that resonate with consumers, that have found success by putting consumers first, and look to see what they can do in international markets.”