Oxford Cannabinoid Technologies

The London Stock Exchange listed pharmaceutical cannabis company announced yesterday that it has at last secured MHRA approval for its Phase 1 Clinical Trials for its lead compound.

Business of Cannabis reported in mid-March that OCT’s share price had risen 70% since the start of the month to levels not seen in over a year due in large part to investor anticipation surrounding the MHRA’s verdict.

In an interview with Business of Cannabis at the time, the company’s then recently appointed CEO Clarissa Sowemimo-Coker said the company was expecting to ‘hear from the MHRA any minute’.

Two months later, OCT has now received approval from the MHRA and Wales Research Ethics Committee 2 to commence Phase 1 in-human trials for its lead compound OCT461201, which has shown potential as an effective therapy for chemotherapy induced peripheral neuropathy (CIPN) and IBS.

The enrolment process is set to ‘begin immediately’ and the trial, set to be funded entirely by OCT’s existing resources, is expected to be completed in Q3 2023.

We are pleased to announce that the Medicines and Healthcare Products Regulatory Agency and the Wales Research Ethics Committee 2 have approved the #OCTP combined Phase I clinical trial application for OCTP’s lead drug candidate, OCT461201.https://t.co/lxYYCgHJwU pic.twitter.com/p3W2FJrtVV

— Oxford Cannabinoid Technologies (@OxCanTech) May 17, 2023

“We are absolutely thrilled to have passed this very significant milestone… We are moving ever closer to achieving our core aim of improving the lives of patients living with debilitating pain, whilst also, ultimately, delivering value for shareholders.

“This is an important step for the Company and part of our broader strategy which currently incorporates four drug development programmes.”

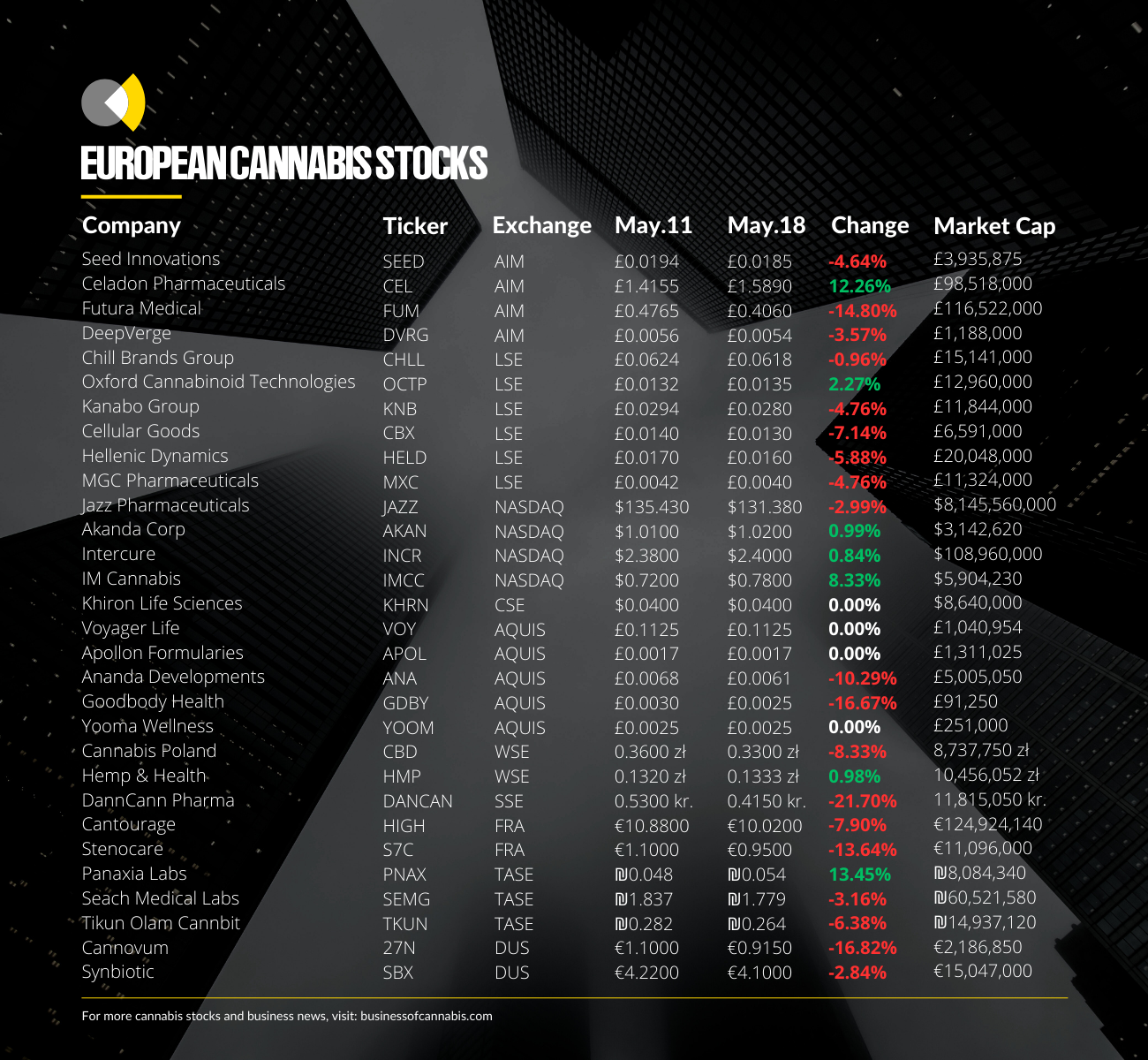

At the time of writing, the news is yet to have much of an impact on the company’s share price, increasing marginally week-on-week.

Though its share price has held since the 70% rise in mid-March, and looks to be continuing a gradual increase, it is still some way off the heights seen between its IPO in 2021 and early 2022, like the rest of its LSE-listed peers.

Cantourage

International cannabis producer and distributor Cantourage also saw its stock fall around 7% this week despite posting relatively positive financial figures.

The Frankfurt Stock Exchange-listed group published its preliminary Q1 2023 results last week, achieving profit for the first time in its history.

During the quarter Cantourage reported a profit of €0.1m on sales of €4.8m, telling investors that this demonstrated ‘it is already possible to compete profitably in the medical cannabis market’.

According to CFO Bernd Fischer, this ‘satisfactory’ profitability was driven by ‘sales increases and improved purchasing processes and conditions’.

Citing the recent ‘discontent among cannabis companies’ relating to Germany’s shift in strategy regarding its adult-use market roll out, which has seen stock in a number of German operators heavily impacted, the company assured investors that ‘our business model works completely independently of any legalisation of cannabis.’

Its CEO Philip Schetter added: “The European markets for medical cannabis are still in their infancy. With our business model, we can quickly and successfully open up new, growing sales markets today and in the future – without having to accept high losses.”

DanCann Pharma

The Danish medical cannabis operator has seen its stock drop over 20% this week following the release of its full-year financial report for 2022, despite some analysts suggesting it is on the verge of breaking even.

Throughout 2022, DanCann reported net revenues of DKK 5.7m (£660k), up significantly from its 2021 revenues of DKK 874k.

This was largely down to ‘record sales’ of DKK 2.1m in Q4, driven by its subsidiary CannGros, which imports and distributes Bedrocan, Bedica and Bediol to Danish pharmacies.

Its Founder and CEO Jeppe Krog Rasmussen told investors in the report that the company is now ‘ready to fulfil our commercial goals, aiming for DKK 60-100 million in annual revenue between 2025 and 2027’.

He suggested that a sales pipeline of DKK 80m over the next three years, generated from two binding contracts signed over 2022, would help the company achieve this ambitious financial target.

Despite the positive growth, DanCann still posted an EBITDA loss of DKK 14.2m for the full year, up slightly from a loss of DKK 13.6m in 2021.

Following further fund raises totalling DKK 31.2m in 2022, bringing the company’s total to over DKK 100m, DanCann said it now currently holds assets valued at over DKK 75m.

However, the company cautioned that ‘at the time of approving the annual report’, it does not have the necessary capital to implement all the company’s initiatives and operations for the 2023, and is therefore relying exercising its outstanding ‘TO2’ warrants to raise funds.

“The company anticipates that it will be able to raise funds, through its TO 2 warrants, which are scheduled to become effective in May. Due to the TO 2 warrants’ built-in mechanism, the company perceives that they are highly likely to provide liquidity and enable the payment of the current outstanding loan, thereby allowing the company to become debt-free after May 2023.”